Purchase Price Allocation for Private Schools

Purchase Price Allocation for Private Schools

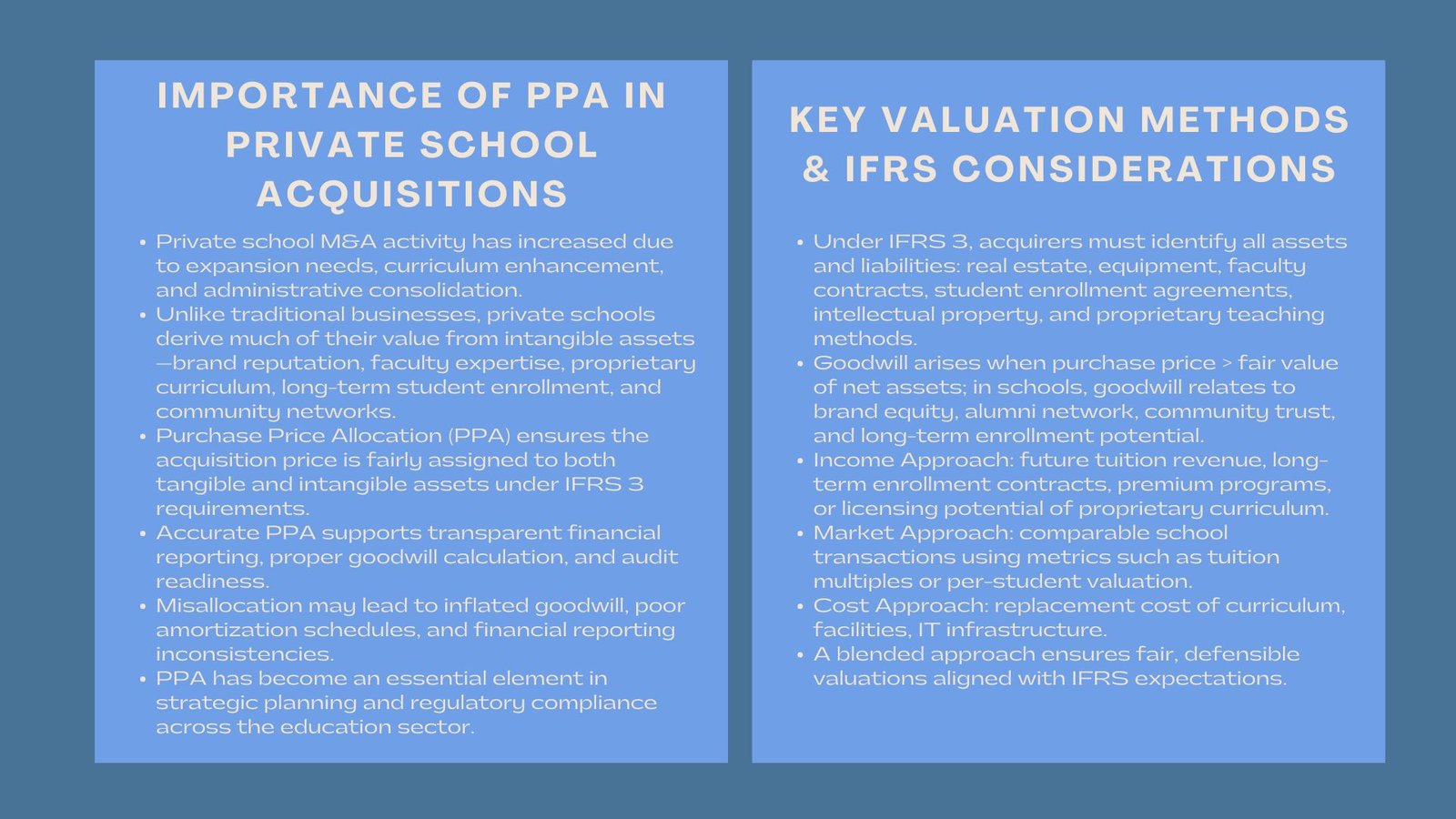

In recent years, the education sector has recorded a lot of activity in terms of mergers and acquisitions, especially by the private schools. With the institutions seeking to increase geographically, improve their learning programs or merge their administrative tasks and functions, acquisitions of the private schools have also assumed the growth strategy. In contrast to conventional business ventures whose main assets are largely tangible, the intangible assets of the private schools such as the known student enrollments, faculty experience, curriculum proprietary city, brand recognition and community contacts make significant contributions to the overall values of the schools.

PPA of the purchase price in the case of private school is an important practice, both in the challenge of regulatory compliance and the strategic and operational planning. Proper allocation of the acquisition price will assist the financial statements to be prepared on the fundamental worth of the intangible and tangible assets, adheres to the IFRS framework on reporting educational institutions and gives the visibility to audit groups, shareholders, as well as the authorities. Misallocation can lead to private school purchase price allocation, unreasonable goodwill, poor amortization records and possible disagreement in the financial reporting process; the PPA process is now necessary in educational enterprises.

Evaluation of Purchase Price Allocation in Private Schools

The Concept of PPA in Educational Institutions

Purchase price allocation can be defined as the activity of allocating a total acquisition cost of school on identifiable assets and liabilities. In private schools, the physical properties may involve real estates, classroom furniture, laboratory equipment, computer infrastructure and school buses. However, intangible assets can in many cases add a larger share of total value. These are the brand reputation of the school, development of its curriculum, the proprietary pedagogical approaches, agreements of enrolment of students in the long run, and the credentials and the experience of teaching staff and faculty.

Properly assigning the purchase price among these assets would guarantee that all assets are accrued by the acquiring institution at fair values as well as the goodwill being accurately calculated. Goodwill will be the difference between the total purchase price less the fair value of the net assets. Goodwill in the education sector could also entail the benefits that cannot be verified like the recognition of the community, allegiance of the alumni, and even scholarly data records which have a direct effect in regard to the future enrollment and revenue possibilities.

Strategic Implications of Accurate Allocation

Proper PPA will offer the management of a privately-managed school practical information regarding the assets, which generate the greatest proportion of value-generation. Finding the value of faculty knowledge or proprietary programs can be used to make investment choices, faculty retention practices and curriculum development programs. Similarly, the importance of student enrollment agreements will enable the school to concentrate on predicting the tuition revenue and manage the expansion plans and operational budgets better.

In the case of the private schools, proper PPA can also give the financial statements their much-needed credibility so that the institution can have confidence in the stakeholders, so that it can support the funding system and cope with the regulatory reporting of such information. An open process of allocation will follow the realistic basis of financial planning by avoiding the chances of overestimation or wastages of vital education assets.

IFRS Reporting Considerations for Education Institutions

Applying IFRS 3 in Private School Acquisitions

These include IFRS 3 which establishes external requirements on the recognition of the goodwill to the fair value and appropriate measurements of business combination. In the acquisition of a private school the acquiring entity shall determine and determine and shall determine all the tangible and intangible assets and liabilities such as real estates, teaching equipment, faculty contracts, student enrolment contracts and intellectual property.

Goodwill will emerge because the purchase price is more than the net asset fair value. In the case of the private schools, goodwill can typically depict the past reputation of the school, community base, network relationship of the alumni and brand recognition of the school, which is subject to future revenue generation. Properly recognizing and distinguishing goodwill will make the financial statements reflect the real economic worth of the school which will make it easier to report on, comply with audits and allow it to attract the confidence of investors.

Challenges for Education SMEs

The adoption of IFRS-compliant PPA is fraught with a number of challenges experienced by private schools, especially the small and medium-size schools. These issues are lack of internal accounting skills, inability to value intangible educational assets and the lack of similar market information to help in the same. The value of faculty contracts, proprietary curriculum, and long term projection of student enrollment may not be readily measurable but it is perhaps the majority of the economic value of the school.

These difficulties can be reduced by hiring independent appraisal firms that have expertise in learning institutions. A believable, justifiable, and accountable reporting of IFRS 3 and a school that is using the private school can have a valuable report, thus ensuring compliance with regulations, and readiness to audit.

Techniques for Private School Assets

Economic Benefit Valuation

The revenue-oriented method is usually used in intangible assets in the private schools. The approach uses the value of anticipated cash flows in the future as calculated by considering tuition fees, student enrolment contract, and related fees like extravagant programs or lodging facilities.

As an illustration of calculation, it is possible to find the value of the long-term student-enrolment agreements by estimating the anticipated sums of the tuitions to be paid during the period of the contract and discounting to the present value, considering the existing situation on the market and the possible inflation and thus the loss of a student. On the same note, proprietary curricula or educational technology platforms may be appraised on the basis of their capability to earn more by way of licensing or achieving a transition to other organizations.

Empirical Market-Based Valuation

The value of the market is based on the comparables of the recent acquisitions of similar education institutions. These comparables may be scarce on the face of limited kinds of similar deals involving the peculiarities of private schools, but transaction multiples in terms of tuition income, the number of students attending, or the value of assets could be effective as a reference point. This will enable the acquiring organization to substantiate income-related valuations as well as guarantee that intangible assets are not undervalued as compared to market patterns.

Resource Cost Valuation

The cost approach considers the replacement cost of tangible and the intangible assets. The typical value to determine in classroom furniture, laboratory equipment, IT infrastructure and improvement of real estate is at current market or replacement value. Proprietary methods of teaching are another example of intangible property that can be suggested to be measured upon its development or implementation cost. Although simple, cost-based approaches might not adequately reflect the revenue generating potential or strategic value of intangible assets so a combination of multiple approaches is essential.

Converged Methodologies for Accurate Valuation

A healthy PPA process combines income based, market based and cost based methods in order to get a balanced, defensible appraisal. Such a combination assures that tangible and intangible items are properly captured, goodwill value is fair and that the financial statements of the acquisition are consistent with the standards of reporting requirements in the IFRS 3.

Analytical Challenges in Allocating Purchase Price for Private Schools

Valuing Faculty and Staff Expertise

Faculty and staff expertise and experience can be considered as one of the most vital intangible assets in the private schools. Inclusion of human capital implies that the assessment is based on relevant qualification, years of experience, results of students and retention rates. It could have long term incentives of faculty contracts and this reason makes it necessary to consider both the present and future commitments on the allocation.

Estimating Brand and Reputation Value

The brand and reputation is a key factor that has been successful in attracting students and ensuring an essential flow of tuition. To assess these intangibles, it is necessary to examine past trends in enrollments, educational results, the activity of alumni and community reputation. Excessively inflating the brand value will contribute to exaggerating the goodwill whereas underrating this brand value will result in lack of enough investment in marketing or community associations.

Quantifying Student Enrollment Agreements

Student enrollment contracts on a long-term basis will give dependable revenue sources, but this value can vary according to the retention rates, a tuition fluctuation, and competition in the market. Proper forecasting is the key to income-based valuation and guarantees that the anticipated revenue is real and facilitates financial planning and investment processes.

Integration and Reporting Complexities

Integration following the realization of the acquisition is the identification of goodwill, development of intangible credit schedules, and tax ramifications. Provided that small private schools cannot easily handle such processes in-house, it is necessary to resort to professional guidance. The correct integration will make sure that there is IFRS 3 compliance, proper reporting, and continuity in its operations.

Documentation and Transparency

Having all valuation assumptions, methodologies and supporting documentation is also important to show transparency, defense audit and confidence by the stakeholders. An in-depth reporting makes sure that the auditors, regulators, and investors know the reasoning behind the purchase price allocation, which minimal controversy can arise and bolster the reality.

Significant Benefits of Accurate Purchase Price Allocation

Informing Operational and Strategic Decisions

Correct PPA gives the school management an insight into the value drivers like the quality of school faculty, proprietary curriculum, and student loyalty. These are insights that can be used in making strategic decisions on the allocation of resources, retaining of faculty, investing in infrastructure and developing programs.

Enhancing Compliance and Risk Management

Audit risks are reduced through complying with IFRS 3 and appropriate allocation of purchase price which results in true financial reporting. Open disclosure also helps in building investor as well as regulator confidence whereby the acquisition has been put to test and can be explained.

Supporting Long-Term Growth

The proper allocation would enable the management to concentrate on efforts to maintain the competitive advantages, high quality education standards as well as high efficiency in the operations. In the long run, these intelligences will improve the financial performance, reputation, and position of the school, and ensure that the acquisition is a source of long-term strategic value.

Practical Example of Private School PPA

Take an example of a takeover of a private school that has been purchased at the price of 5 million. The physical assets comprise classrooms and the furniture worth 1.2 million dollars, information systems worth 300,000 dollars and lab equipment worth 200,000 dollars. Intangibles are school expert knowledge that has a value of 800,000, admission contracts worth 1 million and proprietary curriculum worth 400,000. Outstanding vendor payables debts and lease obligations are both liabilities (200, 000 and 100,000 respectively). The remaining amount that would be purchased would be the goodwill of one million dollars.

The given example shows the support that detailed allocation provides to financial planning, regulatory compliance and operational decision-making, which is useful in offering the PPA a workable framework in educational facilities.

Conclusion: Guide on Purchase Price Allocation for Private Schools

An allocation of purchase price in relation to private schools is a complicated, but necessary procedure that incorporates accounting accuracy, strategic knowledge as well as the structured adherence to the rules of the IFRS. Correct valuation of both tangible and intangible assets, faculty expertise, proprietary curricula, student enrollment agreements and real estate guarantees proper reporting, transparency and can be audited.

Accurate PPA is not just a necessary regulation to a private school, this is also a strategic tool in making operational decisions, increasing the confidence of the stakeholders, and enhancing long-term growth. By education IFRS reporting with professional advice and sound methodologies, educational institutions will be able to obtain all possible value in regards to the acquisitions, and meet the requirements of the IFRS 3 reporting standards and gain sustainable triumph in the competitive and dynamic industry.