Purchase Price Distribution in Boutique Retail Stores

Purchase Price Distribution in Boutique Retail Stores

Introduction to Purchase Price Distribution in Boutique Retail Stores

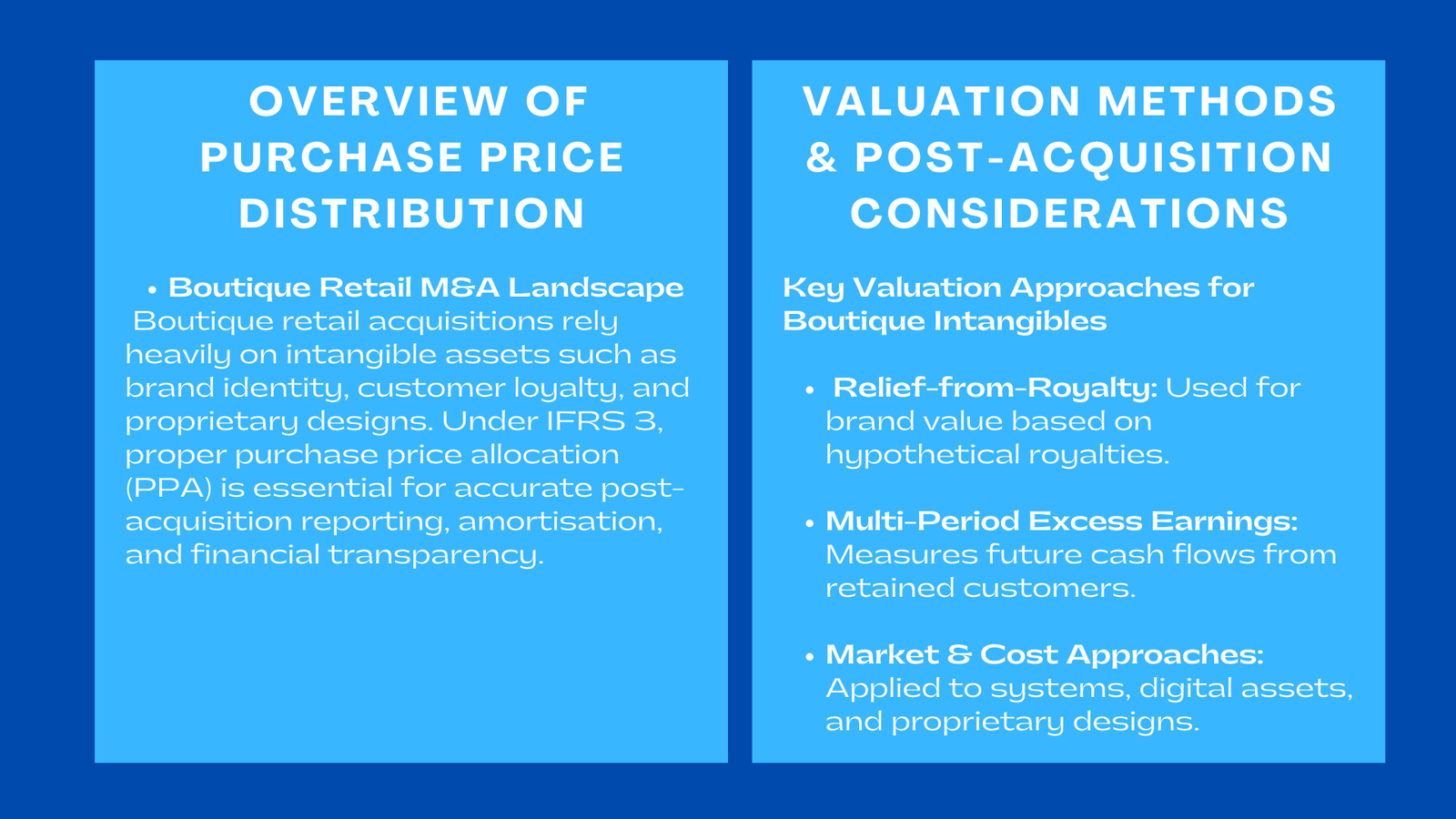

The purchase of a boutique retail store is not as simple as buying physical inventory and leasing it over. The value that is generated in the current retail landscape, characterized by niche branding, experiential buying, and a differentiated customer base, is more often held in the intangible assets than in stock. Correct allocation of purchase price is critical in IFRS 3 because it determines the post-acquisition reporting, subsequent amortisation cost and the financial storyline of the acquisition process, making purchase price allocation backup consulting Singapore an essential support for ensuring accuracy and compliance.

This article concentrates on one critical element of PPA in the retail sector, namely purchase price allocation to intangible assets that are the impetus to the performance of boutique retailing. It discusses the valuation techniques, reporting issues and industry-specific aspects as applied to fashion boutiques, lifestyle stores, artisanal retail concepts and niche brand operators.

1. Why Intangible Assets is prevailing in Boutique Retail Acquisitions.

1.1 The Retail Revolution of Product-Centric to Brand-Centric.

Boutique retail stores are greatly dependent on identity, ambiance, and loyalty by consumers. In contrast to the mass retail chains, where value may be inclined to scale and volume, competition of the boutique operators may be based on their product assortment, narratives of craftsmanship, and personal experience of their customers. This often makes intangible assets to be more strategic than the actual stock.

When performing boutique retail purchase price allocation, analysts often discover that brand equity, customer relationships, and proprietary product designs outweigh the fair value of physical assets such as shelving, point-of-sale systems, and display fixtures.

1.2 The Importance of Customer Loyalty in Small Retail Settings

Community affinity and repeat spending are a characteristic aspect of boutique retail. Numerous small shops keep base clientele in terms of membership, sneak preview, or custom styling. These relations constitute an intangible asset having quantifiable economic value.

To model the cash flows of these customers, valuation teams need to analyze the purchase history patterns, frequency of visit, preference of product categories and retention patterns. A high retention level and high price elasticity tend to result in a large intangible allocation.

2. Recognizing the Intangible Assets with the Highest Value.

2.1 Brand Name and Boutique Identity.

The brand identity of a boutique is its largest asset. The brand communicates a lifestyle, no matter whether the store is handcrafted jewellery, designer apparel, natural products or a selection of home decor, to a group of narrow yet loyal customers.

Measuring brand value will entail an analysis of online presence, customer perception and visual consistency of identity, and reputation of the store in its niche. The relief-from-royalty approach which is an income-based technique is commonly used and estimates the amount of royalties that a would-be purchaser would pay to use the brand, in case of licensure and not ownership.

2.2 Product Designs and Vendors and Proprietary.

A lot of boutique stores sell their own brand or limited partnerships with the makers or small manufacturers. Another intangible property is these proprietary designs. Small scale production also makes them unique relative to mass production making them customer loyal and able to command a high price.

The relationships with vendors are also important, particularly in cases when the boutique depends on small-scale manufacturers. Established collaborations with crafts or small designers decrease the risk of supply and help to offer differentiated products, which add to intangible values.

2.3 Customer Lists and Customer Engagement.

The lists of customers, which can be found in CRM systems, e-commerce databases, loyalty applications, or mailing subscriptions, are identifiable intangible assets. Analysts should find the monetisation potential of such lists in terms of cross-selling, repeat purchases and the response rate of the promotional campaigns.

The proper organization of CRM database and the presence of active engagement indicators is the reason to specify a greater share of purchase price to this intangible asset category.

3. The Methods that are applied in the process of valuating Boutique Retail Intangibles.

3.1 Income Approaches to the Brand and Customer Assets.

The intangible valuation of boutique retail is mostly dominated by income-based valuation techniques. To value a brand the relief-from-royalty method is employed and involves the application of notional royalty rates and predicted revenues to determine value. In customer relationship, the multi-period excess earnings method ascertains future cash flows produced by retained customers less contributory asset charges.

These methodologies provide a defensible valuation narrative under IFRS small business reporting, ensuring that the allocation aligns with measurable, supportable economic benefits.

3.2 Market and Cost Approaches for Supporting Intangibles

There may be some intangible elements, such as the customer engagement systems or loyalty application software, which may need hybrid valuation models. The cost methods are used to indicate the time, investment and building effort that was used to develop these assets and the market methods determine comparables where there is a license agreement or subscription based valuation reference.

3.3 Boutique Retail-specific Valuation Problems.

Boutique retailing is very seasonal, fashionable, and consumer taste shift. These are some of the factors that make forecast modelling difficult since loyalty is not always a predictable purchasing behavior. Moreover, most of the boutiques are partially based on the personal influence of the founder, leading to the question of the transferability and sustainability of the brand value in case of a change of ownership.

4. There Is the Distribution of Purchase Price in Intangible Categories.

4.1 Separating Brand and Personal Identity.

In other boutique purchases, the name might be mixed with the image or the style of the founder. Analysts should ascertain the issue of the brand value without the active founder engagement. Such difference has a bearing on the intangible value that is assigned to it and it could affect the useful life assumption applied on amortisation.

4.2 Value of Online Presence and Digital Assets.

Physical presence can be supported by e-commerce platforms, social media networks, and libraries of digital content in the boutiques. Economic impact may be on website domains, Instagram followings, product photo archives and customized lookbooks.

Although these digital assets may not be valued at the same value as the large online retailers, they do help with generating leads and maintaining customers hence the need to measure their fair value independently.

4.3 Local Reputation and Social Proof.

The boutique stores are frequently integrated into the neighbourhoods or districts of lifestyle. Good reputation through word of mouth, engagement by the community, and familiarity to the locals affect the inflow of customers. Although less measurable, these traits reveal themselves in valuation in the form of revenue stability and customer stickiness.

Analysts are required to draw the line between goodwill-non identifiable intangible value and identifiable assets that directly produce quantifiable cash flow.

5. Reporting and post acquisition considerations.

5.1 Useful Life and Strategy of Amortisation.

The intangible assets of retail that can be identified in boutique retail are usually limited in service life. Brand assets can be between three and ten years old, whereas customer relationship may have shorter cycles with respect to the frequency of consumer buying.

Proper and precise useful-life determinations affect future Patterns of amortisation, which affect profits as reported. The financial performance may be distorted by over- or under-estimating useful lives and providing audit challenges.

5.3 Post-Allocation Performance monitoring.

After the allocation of the purchase price, the management should constantly check the performance forecasted against the actual performance to make sure that the assets are not impaired. Boutique retail is volatile; fluctuations in foot traffic, changing tastes or disruptions of supply can lead to fair-value review.

Frequent review helps to confirm that intangible value is in line with the realities in the marketplace and the risks of impairment of goodwill are detected at an early stage.

Conclusion

In case of boutique retail acquisitions, the value drivers are intangible assets rather than the physical inventory. It is important to realize that by properly assigning purchase price to brand identity, customer relationships, proprietary product designs, and digital presence, the actual financial reporting will be accurate and that the underlying strategic assets will set the future performance in perspective.