Purchase Price Split in Small Boutique Hotel Deals

Purchase Price Split in Small Boutique Hotel Deals

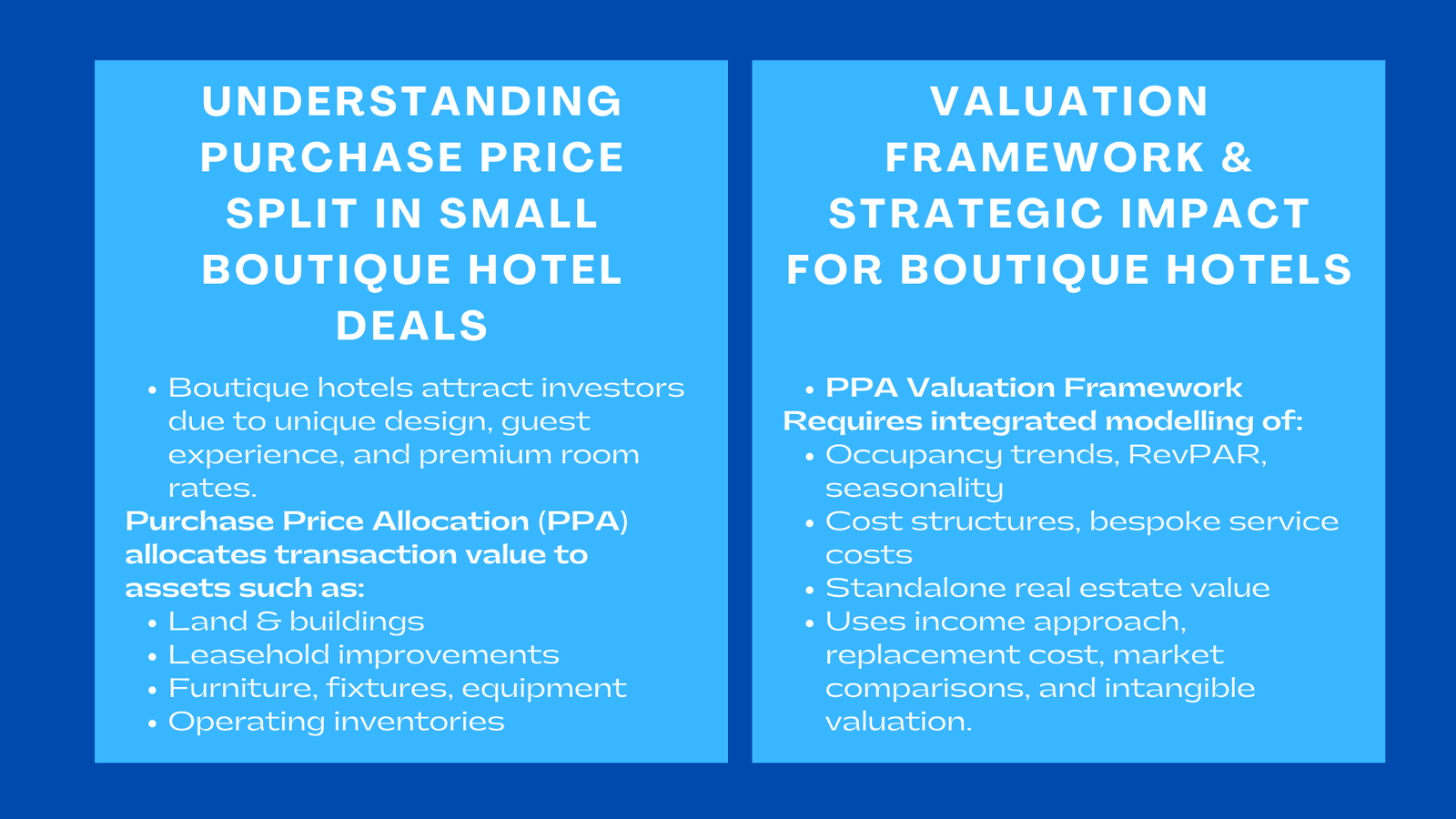

Small boutique hotels have rendered themselves as attractive investment assets due to its charm, unique positioning, and capacity to generate high room rates compared to the standardized chain hotels. As transactions involving these types of properties continue to grow in population from family-run heritage hotels to modern experiential boutique retreats, the financial reporting requirements for these deals have become more stringent.

In the case of acquisitions, one of the major steps undertaken upon the determination of the transaction price is to distribute the purchase consideration among the identifiable assets and liabilities of the hotel. This step, formally called Purchase Price Allocation (PPA) allocates fair value to land, buildings, leasehold improvements and furniture and equipment, operating inventories, brand-value, customer relationships and anything unusual or unique that is an experience, character of the Boutique Hospitality Assets, a process often emphasised in a business combinations valuation course IFRS 3 Singapore for professionals handling such transactions.

For buyers, sellers, auditors, and regulators, a PPA guarantees that the transaction is recognized in compliance with the hospitality IFRS reporting standards, especially IAS 3 reporting standards on business combinations, as well as IAS 16, IAS 38, and IAS 40 on different classes of assets involved in the operations of hotels. When done accurately, PPA is a great strategic tool clarifying the actual economic structure of the boutique hotel that will be purchased.

This article is structured in a way of telling a story with advanced financial modelling techniques but with a focus on the operational realities and valuation differences of small boutique hotels.

The Relevance of Purchase Price Split for Boutique Hotels

Closing the Gap Between Transaction Value and Hotel Operating Reality

Boutique hotels are fundamentally different to the corporate hotel chains because the value is so strongly linked to all the experiential aspects: architecture, local culture, personalised service, thematic interior design and unique guest experience. In many transactions, the price agreed upon on the deal is often an aggregate of these emotional and experiential elements, but the accounting books need to be grounded and rational in how much value each constituent part of the property has.

This is where boutique hotel purchase price allocation becomes essential. It is to ensure that the emotional premium built into the negotiated price is separated into tangible real estate value, operating equipment, identifiable intangibles such as brand identity or curated guest relationships and goodwill. The process is also valuable to investors in understanding if the economic value is more for the reason of the physical quality of renovation, the location advantage, or the historical reputation of the hotel.

By filling in the story of the hotel’s charm and the accounting of its financial structure, PPA is bringing the acquisition story in line with measurable economic drivers. It helps buyers understand what they really paid for and helps sellers make themselves clear about commercial sense regarding pricing expectations. At the end, PPA converts the aesthetic and the experience of the hotel into the financial reportable elements under the standard frameworks of IFRS.

Increasing Deal Complexity in Small Hotel Transactions

Even though many boutique hotels are small, privately owned, and uniquely designed, the nature of the transactions of hotels have become much more complicated. Many of the deals are now of layered assets, hybrid operating models and with mixed effects in real estate, sometimes a combination of hotel, cafe, spa, events or partially for residential use.

From an accountant’s perspective, these deals require accurate classification and valuation for hospitality IFRS reporting. Portions of land and buildings need to be measured at fair value. Leasehold interests should be considered. Furniture, fixtures and equipment must be segregated by useful lives. Intangible assets – including artisanal brand reputation, or guest loyalty that may be curated or individual – must be identified, and valued differently from goodwill.

This complexity has made structured purchase price splits more required that accurately reflect the boutique hotel’s operational structure without becoming in total non-compliance to international financial reporting standards.

Basic Areas of Purchase Price Allocation for Boutique Hotel Assets

Designing and Structuring the Valuation Framework

The PPA model involved in boutique hotel acquisitions have to begin with a well-integrated valuation approach that reflects the play of interplay as well as the interplay between hospitality operations and real estate economics and intangible experiential. The model requires a good knowledge of occupancy trends, revenue per available room (RevPAR), seasonal demand cycles, maintenance expenditure and cost structures that are specific to boutique hotels, such as bespoke interior maintenance or specialized guest services.

This is an integrated model that guarantees the final allocation is based on financial and operational logic. When reviewing the allocation, auditors are expecting to see obvious links between the performance of the hotel in the past and its expected earnings capacity and the fair value of its identifiable assets. Therefore, the structure of the model requires for example to be transparent, and measurable, as well as to be aligned consistently with the requirements of the IFRS for hotel components.

Valuation Approaches and Their Application in Boutique Hotels

The valuation exercise will normally start with an income approach to valuation, where the future cash flows arising from room bookings, food and beverage operations and ancillary services are projected based on realistic operating assumptions. This forecast is based on occupancy patterns, competitive dynamics, pricing flexibility and unique positioning of the boutique hotel in the tourism ecosystem.

Beyond the income approach, often the real estate component will need some benchmarking against similar hotel transactions or land valuation analysis to ascertain the standalone fair value of land and buildings. Furniture, fixtures and equipment must be valued according to replacement costs and useful lives remaining and inventories ranging from linens and minibar stock to boutique amenities must be valued at fair value.

Intangible assets in boutique hotels need particularly good consideration. Unlike the branded chain hotels where intangibles are frequently associated with standardized franchise systems, in boutique hotels, much weight is put on localized brand identity, guest loyalty and experiential differentiation. These unique features may provide support for fair value recognition for hotel brands, curated customer relationships, or special techniques of operation. Whatever cannot be attributed to tangible intangible assets become goodwill.

Scenario and Sensitivity Considerations

Hospitality industries are very vulnerable to economic cycles, travel moods, geopolitical reasons, and domestic tourism forces. PPA should, therefore, include the use of scenario testing to know the impact of a change in assumptions on the values of assets.

An occupancy rate change, such as one, may have a major impact on what intangible assets like brand or customer relationships have in terms of value ascribed. Sudden increases in the maintenance expenses may change fair value estimates of building enhancements or apparatus. The travel bans may reduce the revenue estimates and hence reduce the enterprise value of the hotel, altering the distribution of the purchase price among asset groups.

This scenario testing, in both buyer and seller negotiation alignment, is necessary and should also be used to make sure that the final allocation will pass the audit examination. Sensitivity analysis will enhance the credibility and build of the results valuation.

Integrating Hospitality Accounting with Strategic and Operational Realities

Fair value measurement is not the end of PPA of hotels that work with boutique hotels. It has to go back to operational strategy. Reported profitability will be affected by depreciation that will be based on fair-valued assets. Intangibles amortization to adjust the earnings trend of the hotel will redefine the hotel. The capex planning that will be done in the future will be informed by adjusted carrying values of equipment and buildings.

This collaboration with hospitality IFRS reporting appears to make sure that financial statements are used to create a realistic image of the economic aspects of hotel operation. Rather than just adhering to the accepted accounting norms, the boutique hotel would have clarity that would reinforce financial discipline, investment planning and management accountability.

Implementation in Boutique Hospitality Settings

Purchase Transactions and Post-Acquisition Integration

When it comes to the deals of the boutique hotels, the allocation process constitutes the bridge between transaction pricing and financial reporting in the long term. When the purchase is made, the buyer will have to translate the transaction price into a structured system of fair values which would allow embedding into books of the hotel. This includes revising depreciation of buildings and equipment, the path of amortization of the intangible property, and goodwill to be tested as being impaired every year.

Regarding small exhibitors of a hotel, most small boutique hotels, including those that are run by the family, this process of allocation preconditions the clear financial communication the hotel will have with its lenders, investors and regulators. It also makes sure that the financial path of the hotel is on track with the financial forecasts that are incorporated into the acquisition model.

Portfolio Management for Boutique Hospitality Groups

Investors controlling more than one boutique hotel need to have a consistent valuation allocation process in order to take the performance of different properties as a benchmark. An identifiable purchase price division assists in determining which hotels are more driven by brand equity, which are operationally advantaged in place or design and which must have capex to continue its value in the future.

This transparency promotes choices on capital allocation, assists portfolio managers on future expectations of impairment of assets and enhances the strategic plan on renovations or repositioning.

Valuing Boutique Hospitality Intangibles Under Uncertainty

The intangible, culturally ingrained factors that frequently create the charm of the boutique hotels include heritage architecture, local authentication experiences, ancient customer devotion, boutique service ideologies, or aesthetic identities. Most of them are intangible assets which can or cannot be recognized under the IFRS.

ASR of fair value involves a profound qualitative insight into what makes the hotel different and a quantitative analysis of the impact of the differentiation on economic performance. This is one of the most subtle elements of the PPA of a hotel that is considered a boutique hotel.

Improving Strategic and Analytical Thinking for Hotel Owners

Developing a Valuation-Aware Mindset

Hotel owners who enter investments in PPA are more analytical of what they own. They get an insight into how the satisfaction of the guests, location premiums, maintenance of the building, service differentiation, and the storytelling of the brand can be converted into quantifiable financial value. This awareness can be considered transformational since the owners will be able to make decisions with a better picture regarding the economic effects on the long term.

Strengthening Communication With Stakeholders

A good PPA gives the owners and investors a chance to relate more with the banks, regulatory and financial institutions. It is also indicative of discipline, and it increases the level of credibility and bodes the financial narrative of the hotel with international reporting standards. Since, in many cases, the operation of a boutique hotel is directly dependent upon charisma and image, the capability to translate this charisma to quantifiable financial statements becomes a valuable competitive edge.

Integrating Technology and Automation in Boutique Hotel Valuation

Using Modern Modeling Tools

The concept of having hospitality valuation models built around property management software, guest review analytics, occupancy boards, and revenue management applications continue to become part of the big picture. The data will improve the accuracy of cash flows estimations and increase the plausibility of values of intangible assets.

The fact that technology is integrated also saves errors and updates in real time, which is vital in markets where there is rapid transformation in the tourism trends.

Enhancing Decision-Making Through Data Connectivity

A network of valuation models linked to operational information, such as room rate strategy, occupancy, event bookings and guest loyalty indicators, will constitute a living ecosystem in which financial reporting is kept in step with on-the-job hotel performance. This consistency facilitates the sustenance of the future adherence to hospitality IFRS reporting and also enhances the internal decision-making.

Advantages of Strong Purchase Price Allocation in Boutique Hotel Deals

Creating Professional Discipline

Even a tiny boutique hotel is transformed into a financially advanced property by a structured PPA. It promotes responsibility, enhances better governance and commendable investment planning that is based on fair value measurement.

Enhancing Agility in a Volatile Sector

The markets in the hospitality sector change very fast. The value of a hotel may vary as a result of entry by new players, changes in preferences of customers on the nature of traveling, renovation of adjacent hotels, or as a result of macroeconomic shock. A strict PPA can assist proprietors to foresee such changes and modify plans in a suppliant way aided by an in-depth knowledge of which assets and experiences build the most economic value.

Strengthening Institutional and Investor Confidence

Whereby the owner may have an expansion plan in the future, franchising, bombarding, or selling, it is better to have a clean division of purchase price, which increases institutional confidence. It gives assurance to the investors that the hotel is being run in a transparent and professional manner and that its financial structure is not predisposed to any regulatory and audit control.

Conclusion to Purchase Price Split in Small Boutique Hotel Deals

The allocation of purchase price has become one of the characteristics in the development of small or boutique hotel purchases. It converts emotive and aesthetic attractiveness of a boutique property to structured, measurably financial, asset profile base compatible with global accounting standards. In the view of the purchase price allocation of the hotel boutique, as well as strict compliance with the hospitality IFRS reporting, the hotel owners and investors will understand the operational strengths of the hotel, essential drivers of intangible value and long-term financial path of the hotel.

Through this approach of engaging in value practices of discipline, the boutique hotels not only make themselves compliant, but also on the path to sustainable growth and enhanced strategic decision making.