Understanding IFRS in Startup Valuation

Allocating Purchase Price for IT Startups under IFRS

Understanding IFRS in Startup Valuation

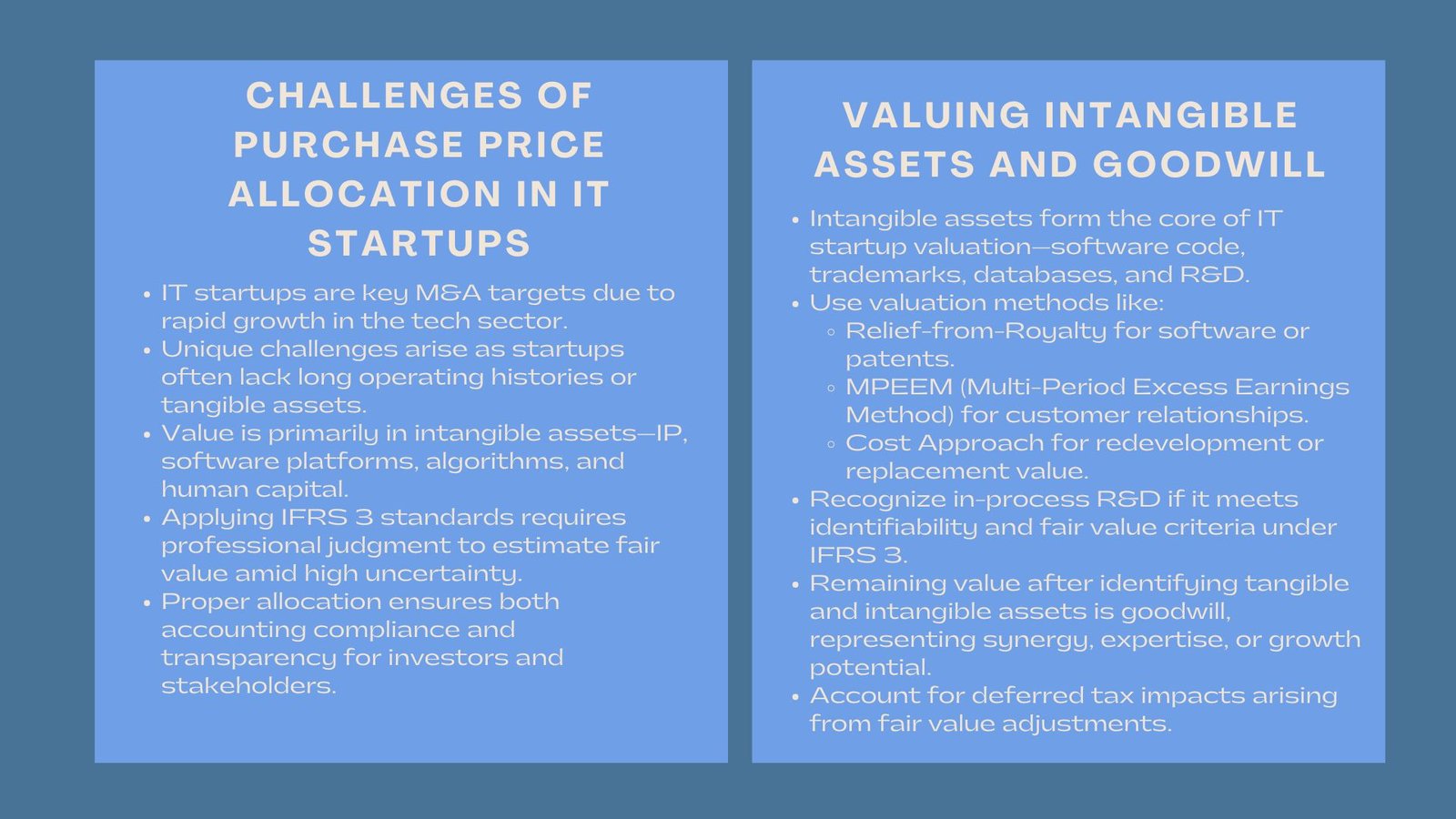

IT start ups have become the best targets of mergers and acquisitions due to the high rate of expansion of the technology industry. Nevertheless, there are special problems when it comes to the distribution of the price of purchase in such transactions. Startups do not always have a long history of operation, and they have few physical assets and their value is often determined by the intangible factors such as intellectual property, software platforms, and human capital. The application of the IFRS 3 standards in these businesses will require a good grasp of the principles of valuation, discretion in estimating the fair values and balancing unpredictability on the early stage of technology ventures.

Adequate distribution of purchase consideration does not only guarantee that the accounting standards are adhered to, but it also assists the investors and other stakeholders to have a clear picture about the actual economic worth of the acquisition.

Special Features of IT Startups.

IT startups, in contrast to conventional manufacturing or service firms, tend to be quite intensive in the aspect of intangible resources. Their primary value inputs often consist of proprietary algorithm, cloud infrastructure, customer databases, software licenses or unfinished R&D. Before the acquisition, in most instances, these assets are not entirely reflected on the balance sheet. As a result, the process of IT startup purchase price allocation requires careful identification and measurement of these intangible assets at fair value.

Moreover, there are many startups that have negative or low profits and reinvest the majority of the funds in the development. This has challenges in making future cash flow projections to enable valuation. Realistic assumptions that are based on the growth potential, market risks, and technology lifecycle of the startup must be applied by finance professionals. The valuation methodology must be optimistic but reasonable enough so that one can substantiate all the assumptions.

Important Processes in determining the purchase price allocation.

According to the IFRS 3 requirements, the acquirer should recognize all identifiable assets that the company acquires, liabilities that the firm acquires and the non-controlling interest in the acquired company as of the acquisition date. The fair value of the identifiable net assets less the purchase consideration is the goodwill.

The distribution usually starts with the fair value of the tangible assets, i.e. equipment, office hardware, or leasehold improvements. Although these are typically modest in the case of IT start-ups, they constitute a component of the entire asset base. The second and even more important action is the valuation of the intangible assets, which can be software code, trademarks, patents, and user relationships. They are usually captured in techniques like relief-from-royalty approach, multi-period excess earnings approach (MPEEM) or the cost approach.

Valuing Intangible Assets

The PPA IT startup is centered on intangible assets. An example of this is software technology, in which the technology may be considered using the estimated license fee or the cost of re-developing the same code. Discounted cash flow methods based on customer retention and recurring revenue models can be used to measure customer relation, subscription database and brand name.

Besides assets that can be identified, the finance teams also need to consider the in-process R&D projects. Under the IFRS 3, these have been identified as separate intangible assets provided they satisfy the identifiability and fair value measurement requirements. Their valuation needs to estimate the probability of coming up with the project, the future cash flows to be generated and technical viability. This step will have a significant effect on the final price allocation of purchase because startups tend to be dependent on the innovation cycles.

Goodwill and Deferred Taxes recognition.

Once all tangible and intangible assets have been identified and measured, a residual amount is the value of goodwill – synergies, expertise in the workforce or future benefits which are not otherwise recognized and identified. In the case of IT startups, goodwill can also be a significant value of the acquisition price, which presupposes a rapid growth and technological scalability.

The issue of deferred tax implications should also be considered very closely, particularly, because the adjustments in fair values of intangible assets can lead to temporal differences in accounting and tax basis. The finance teams are required to compute the deferred tax liabilities or assets in this manner so that the balance sheet can be accurate and compliant.

Applying IFRS 3 in Practice

A comprehensive IFRS 3 business combination guide serves as a framework for handling all aspects of startup acquisitions — from recognition and measurement to disclosure. The IFRS 3 is that identifiable assets and liabilities should be recorded at fair value at the time of acquisition. The provisional values need to be settled during the measuring period which is usually twelve months. In the case of IT startups, it implies that first estimates will have to be reconsidered as more information will become available, especially concerning the performance after the purchase and the retention rates of customers.

Other provisions of compliance with IFRS 3 include elaborate disclosure of valuation methods, under-laying assumptions, and the rationale of significant judgements. Such disclosures are essential in transparency and in making users of financial statements know the rationale behind the reported numbers.

Widely used Pitfalls and problems.

When purchasing IT startups, there are various difficulties that demand professional opinion. The former is that it is challenging to draw a distinction between identifiable intangible assets and goodwill. The majority of start ups have value in the form of the workforce they have assembled and the technological expertise – both factors which IFRS 3 will not allow to be individually recognized. The other issue is an unstable technology industry that will leave future income predictions unclear. It is possible to overvalue assets and subsequently incur impairments because of an overvaluation of growth or undervaluation of technological obsolescence.

Also, the absence of historical data or similar transactions in the market can make the tasks of valuation harder. Sensitivity analysis and scenario modeling are critical in these situations when assumptions need to be proven and their resilience in valuations verified.

Integration and Post-Acquisition Monitoring.

When the purchase price allocation is done, the next thing that is to be done is integration. Standardization of accounting policies, integration of systems and tracking the performance of the acquired startup are vital in ensuring that the financial reporting is not compromised. Finance departments ought to routinely evaluate the reasonableness of the fair values that had been imposed in the course of making acquisitions, especially when there is a shift in market conditions or business realities.

Under the IFRS, periodic testing of goodwill and intangible assets should be impaired. In case the actual performance is lower than the expectations, the impairment losses should be recognized in order to demonstrate the reduction of the asset value. Frequent review helps in the maintaining the economic reality of the acquisition to be consistent with accounting.

Best Practices of Accurate PPA in IT Startups.

In order to handle the challenges of IT startup purchase price allocation, firms are advised to form cross-functional teams that may include financial, valuation, and technology experts. Collaboration between accounting and operations teams at an early stage of the project is necessary to make sure that all the information (both software architecture and customer data analytics) is reflected in the valuation process.

Valuation assumptions, fair value methods, and discount rates should be clearly documented in order to create transparency and conduct audits. The use of external valuation experts can also make the critical estimates independent. Finally, the ability to remain flexible throughout the measurement timeframe enables the finance departments to revise tentative figures as new data is released.

Conclusion

IT startups allocation under IFRS must provide a balance between technical accuracy and practical judgment on the purchase price. With a systematic method that is based on the IFRS 3 business combination guide and uses rigorous IT startup purchase price allocation practices, financial professionals may make sure that their reporting, compliance, and disclosure are accurate. With the way the technology sector is shifting, the ability to navigate the complexities of the startup valuations and PPA processes is a critical skill required to realize successful acquisitions and potential long-term growth following the acquisition process.