Understanding PPA in IFRS Mergers and Acquisitions

Understanding PPA in IFRS Mergers and Acquisitions

M&A is an industry that keeps altering industries and commercial development. But what comes after the dealmaking and strategic fit are essential accounting processes referred to as Purchase Price Allocation (PPA). This is done under the IFRS 3- Business Combinations and this process is core in terms of faithfully representing the financial effects of an acquisition. A clear understanding of PPA is not only critical to businesses that report under the International Financial Reporting Standards (IFRS) in order to comply with the requirements, but it is also effective with respect to strategic decision making, reporting to the investors, as well as enhancement of long-term values.

In this context, understanding M&A valuation process Singapore practices and applying M&A valuation including synergies in Singapore insights are vital for accurate reporting and long-term success. This guide discusses the principles, concerns, and benchmarks of IFRS purchase price allocation and how CFOs, financial professionals, and corporate strategists can manage entities after completing a deal.

What Is Purchase Price Allocation (PPA)?

The process of attributing the total price paid in a business acquisition to the identifiable assets and liabilities of the acquired business at fair value with any excess being recognised as goodwill is called Purchase Price Allocation (PPA). The PPA process helps to get an adequate financial position of the purchased assets and liabilities representing the fair and true view of acquiring company financial statements. In practice, businesses often rely on professional purchase price allocation valuation services in Singapore to ensure compliance and accuracy.

This allocation should be done at the date of acquisition under IFRS 3 and it is one of the largest accounting events after acquisition.

Why PPA Matters in IFRS-Based Reporting

As stipulated in IFRS 3, the applicability of the accounting concept necessitates the reflective nature of the actual economic value of the business combination by the acquirers. This has a number of implications:

- Investor Transparency: Appropriately conducted PPA provides stakeholders with an overview of the elements of the deal, such as the amount paid out of claims of tangible and intangible value.

- Compliance: Non-compliance with the accounting standards may be based on failure to fairly allocate or identify intangible assets.

- Tax Implication: Deferred tax possibility, and amortization can also be influenced by the PPA.

- Future goodwill Impairment Testing: The amount of goodwill secured at the time of PPA is a crucial value in the impairment assessment tests in the future under IAS 36.

IFRS 3 Recognition Principles in Purchase Price Allocation

According to IFRS 3, the acquirer is supposed to identify the fair values of assets, liabilities, and non-controlling interest held by the acquirer. The most critical sets of recognition criteria under IFRS 3 are:

- Measurability:There has to be reliable measurement of assets and liabilities.

- Relevance: They have to inform the users of financial statements with pertinent data.

- Probability of Economic Benefit: The future economic benefits need to be higher with a probability that an asset shall be recognized.

Notably, the drivers of this are intangibles like customer relationships, trademarks, and proprietary technology which, as far as the acquirer was concerned, had never been part of the equation before.

Common Intangible Assets in PPA Valuation

Unlike the tangible assets, intangible ones tend to either be neglected or underreported in internal books. Nevertheless, IFRS 3 makes valuation and recognition to be comprehensive. The most frequently determined intangible assets in the course of PPA are:

- Customer Relationships and Contracts: Particularly useful in industries where customers are very loyal to a firm, or in industries that have long-term contracts.

- Brand Names and Trademarks: Salable in terms of recognition in the market, brand strength and licensing.

- Technology and Software: This is especially pertinent in the case of technology and pharmacy/chemical acquisitions.

- Non-Compete Agreements: Are these contractual, or legally binding?

- Licenses and Permits: They have special interest and desire especially those which can be transferred or are available in limited quantities.

These must be recognized separately from goodwill and measured at fair value.

The Role of Fair Value in IFRS Purchase Price Allocation

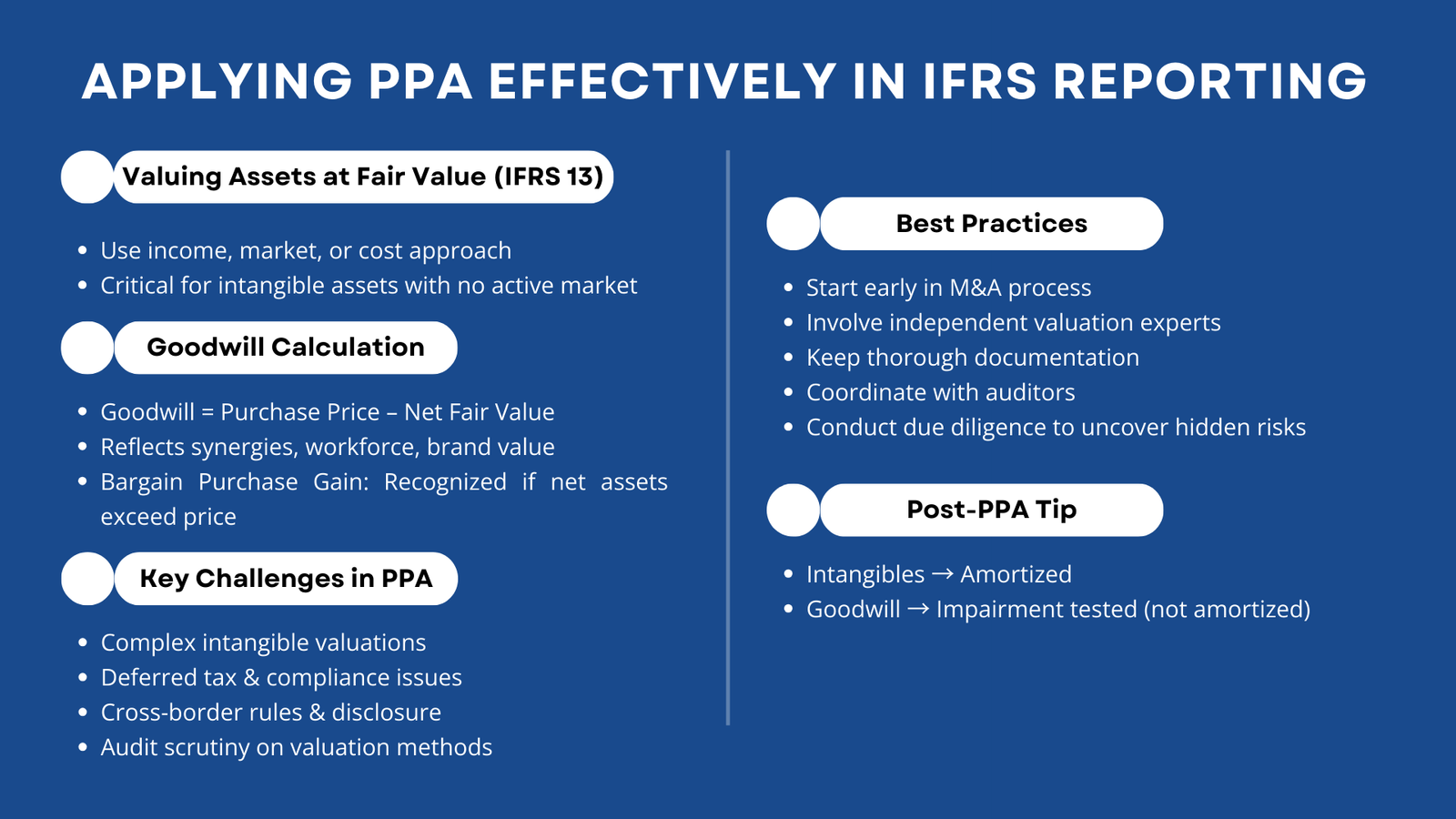

The IFRS purchase price allocation is based on fair value measurement. Assessment Under IFRS 13 References to fair value should be interpreted as the consideration, in form of cash and external material goods and services, that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Depending on the asset valuation techniques employed, the diversity of approaches tends to employ valuation techniques such as, the income approach (e.g., discounted cash flows), market approach (e.g., comparable transaction), cost approach and others.

The intangible assets present difficulties in determining their fair values as they neither have physical existence nor can be estimated on the basis of the future cash flows available. Such valuations should be undertaken on the basis of solid assumptions and documented methodologies.

How Goodwill Is Calculated in Purchase Price Allocation

The difference between the purchase consideration and the net fair value is recognized as goodwill after deduction of the fair value of all the identifiable assets and liabilities. Goodwill reflects future economic advantages of the assets which are not differentiated and are not singly identified.

Goodwill typically includes:

- Synergies that are anticipated because of integration of operations

- The potential to grow in the future

- Assembled workforce

- Market share and image

On the contrary, when purchase consideration is lower than the net assets (which is an unusual case scenario), IFRS 3 necessitates that a bargain purchase gain should be recognised in the profit or loss.

Measurement Period Adjustments in IFRS PPA

Under IFRS 3, the fair values of the assets and liabilities can take up to a year after an acquisition date or time to be completed. In this time, the acquirers can modify provisional amounts in the event of some new information about facts and circumstances being known at the date of the acquisition.

But they will have to be retrospective and adjustments have to be made in the financial statements as though the new facts had been known at the time of acquisition.

Key Challenges in IFRS Purchase Price Allocation

- Valuation of Intangibles: The valuation of intangibles can be complex, particularly, where it appears they do not have good market data to rely upon.

- Tax Considerations: Fair value adjustments have the potential of giving deferred tax obligations that affect future incomes.

- Regulatory Scrutiny: The regulators and auditors oftentimes review assumptions and methods of PPA, particularly in the case of goodwill and intangible values.

- Cross-border Transactions: The tax policies and markets laws of one jurisdiction may differ to that of others making the measurement of fair value complex, and disclosure extremely tiring.

The Strategic Importance of Accurate PPA

Although PPA might look like a compliance measure, strategic buyers know more about it. Well executed PPA:

- Assists in getting the management in line with the strategic rationale of the deal

- Helps in following up on return on investment (ROI)

- Enhancements in post-deal integration planning

- Influences the financial ratios as well as key performance indicators (KPI)

- Implications on future financial reporting are achieved through amortization and impairment

Best Practices for Purchase Price Allocation Under IFRS

In order to ensure companies go through the complexities in IFRS 3 and undertake a defensible PPA, the following best practices may be followed:

- Start Early: The M&A process should involve the fronting of finance and valuation teams early on in the process to counter PPA demands.

- Use Independent Valuers: This would add credibility and accuracy of the process as they are qualified valuation experts.

- Maintain Clear Documentation: Good assumptions, inputs and rationales of fair value estimation should be documented.

- Coordinate with Auditors: There might be activities that need to be done earlier with auditors so that problems are nipped in the bud.

- Perform Robust Due Diligence: By conducting due diligence, Rosrace may be able to identify hidden intangibles or liabilities that have an effect on distribution.

Post-PPA: Managing Amortization and Impairment

After PPA is done, any intangible assets which have definite useful lives, have to be amortized by recognizing the economic life of such assets. This may affect future earnings that may be reported.

Goodwill conversely is not amortized although the asset is annual (or more often) tested in IAS 36 against impairment. The carrying value of the goodwill is written down to its recoverable amount, thus impairment occurs and reduces its carrying amount.

The impairment reviews need the cash flow projections, discount rates and sensitivity analysis that should correspond to those during the PPA used.

Conclusion: Why PPA Is Crucial for Strategic and Financial Success

This is an important accounting process under the IFRS known as Purchase price allocation rule of the business combinations. Besides, it can help to maintain the IFRS 3, it also brings transparency, investor confidence, and higher strategic planning. As the knowledge economy has put greater value on intangible assets, proper recognition and valuation of the same assets have never been more significant.

His or her PPA, whether it is the technology start-up buyout, the cross-border merger, or investing in cross-border expansion, should be a certain and rigid process that proves the foundation to healthy reporting, and decision-making.