Vocational Training Center PPA Certification

Allocation of Acquisition Price in Vocational Training Centers

Introduction to Vocational Training Center PPA Certification

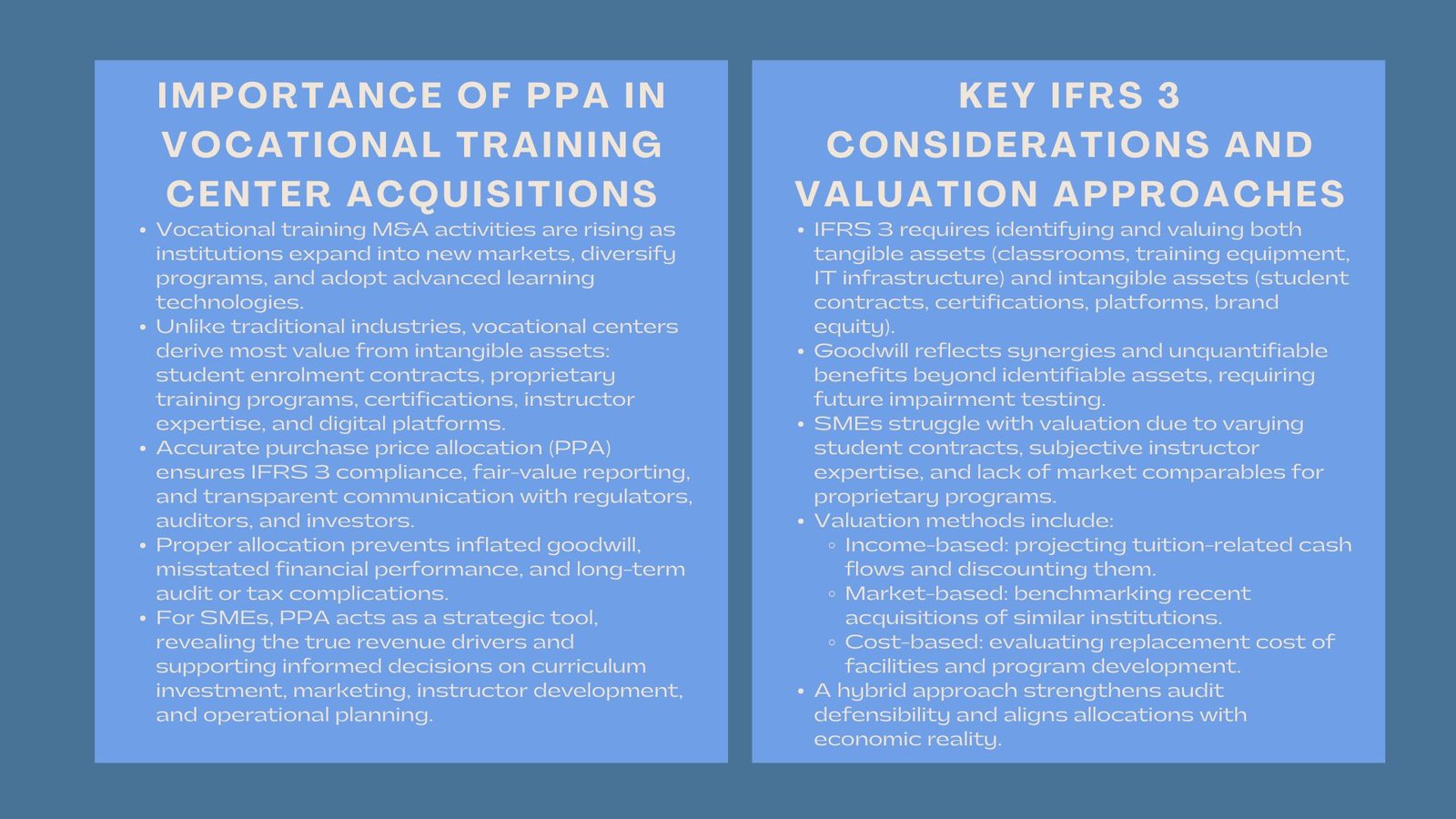

Mergers and acquisitions (M&A) in the vocational training sector are becoming increasingly common as institutions seek to expand program offerings, access new geographical markets, or incorporate advanced technological tools into their educational delivery. Unlike manufacturing or retail businesses, where tangible assets such as machinery, inventory, or real estate dominate the balance sheet, vocational training centers derive a substantial portion of their enterprise value from intangible assets. These include student enrolment contracts, proprietary teaching programs, certification courses, digital learning platforms, and the expertise and reputation of instructors.

Accurate allocation of the acquisition price in such M&A transactions is not merely an accounting requirement; it represents a strategic tool for understanding the real drivers of value in the organization. For small and medium-sized vocational training institutions, adherence to IFRS 3 M&A reporting standards is particularly critical. Proper purchase price allocation ensures that both tangible and intangible assets are recorded at fair value, informs management decisions, facilitates regulatory compliance, and maintains transparency for investors and stakeholders. Misallocation can distort financial statements, inflate goodwill, create deferred tax complexities, and undermine investor confidence, potentially jeopardizing the long-term success of the acquisition.

Comprehensive Overview Vocational Training Purchase Price Allocation

Defining Purchase Price Allocation

Purchase price allocation (PPA) is the accounting process through which the total acquisition cost of a business is distributed among its identifiable assets and liabilities. In vocational training centers, this process involves not only tangible assets such as classrooms, computers, training equipment, and office facilities but also intangible assets that are central to the institution’s revenue generation and competitive advantage. These intangible assets include student enrolment contracts, proprietary training content, certifications, online learning platforms, brand equity, and the skills and experience of instructors.

A thorough PPA ensures that each asset is recognized at its fair value, reflecting its expected contribution to future revenue. This is critical for post-acquisition financial planning, taxation, audit defensibility, and investor communication. For vocational training centers, where intangible assets often account for the majority of enterprise value, accurate allocation becomes a cornerstone of financial integrity and strategic planning.

Identifying Intangible Assets

Intangible assets are often the most valuable and most challenging components of vocational training centers. Student enrolment contracts, which guarantee future tuition revenues, form the backbone of the financial value of the institution. Proprietary programs and certifications, including customized vocational courses, online modules, and blended learning platforms, differentiate the center in a competitive market. Instructor expertise and reputation, though less tangible, directly influence student retention, enrollment growth, and brand credibility.

Recognizing and valuing these intangibles requires a careful assessment of factors such as contract duration, expected renewal rates, tuition levels, student outcomes, and market demand for specific vocational programs. These valuations not only ensure compliance with IFRS 3 but also provide management with insights to guide curriculum investment, marketing strategies, and faculty development initiatives.

IFRS 3 Considerations for Vocational Training Centers

Core Requirements of IFRS 3

IFRS 3 outlines the accounting requirements for business combinations, including the recognition of all identifiable assets and liabilities at their fair value at the acquisition date. In the context of vocational training centers, this requires careful evaluation of tangible assets like classrooms, IT infrastructure, and administrative resources, as well as intangible assets such as student contracts, digital learning platforms, and instructor knowledge.

Goodwill represents the excess of the acquisition price over the net fair value of identifiable assets and liabilities. It reflects the expected synergies, operational efficiencies, market potential, and intangible value that cannot be separately quantified. Proper recognition of goodwill is essential, as it affects future financial reporting, amortization, and impairment testing under IFRS standards.

Challenges for SMEs in IFRS 3 Reporting

Small and medium-sized vocational training centers often face unique challenges in implementing IFRS 3. Limited accounting resources, lack of internal expertise, and the subjective nature of intangible asset valuation can create difficulties in achieving accurate reporting. Student contracts may vary widely in terms of tuition, length, and renewal likelihood, complicating revenue projections. Proprietary training programs may not have observable market comparables, making valuation assumptions subjective. Instructor reputation and experience, which are crucial for attracting students, are inherently qualitative and difficult to quantify.

In such circumstances, engaging professional valuation experts or consultants can help SMEs apply defensible methodologies, document assumptions, and ensure audit-readiness. A well-executed PPA under IFRS 3 provides clarity on the contribution of each asset to the center’s economic value, facilitating informed management decisions and strategic planning post-acquisition.

Strategic Benefits of IFRS 3 Compliance

Compliance with IFRS 3 delivers multiple strategic advantages. Accurate valuation of student enrolment contracts and proprietary programs enables management to identify high-value areas for investment, enhance operational efficiency, and strengthen student engagement strategies. Transparent financial reporting increases confidence among investors, auditors, and regulatory authorities, minimizing potential disputes. Furthermore, accurate allocation allows organizations to plan for amortization and impairment testing effectively, ensuring that post-acquisition financial statements accurately reflect economic realities.

Principles of Enterprise Valuation Methodologies for Vocational Training Center Assets

Income Stream Analysis

The income-based approach is often the most suitable method for allocating purchase price in vocational training centers. This method involves estimating future cash flows attributable to specific assets, such as student enrolment contracts, proprietary training content, or online platforms, and discounting them to their present value. This approach considers both the time value of money and risks associated with the continuity and performance of the assets. By linking asset value directly to expected future revenue, the income-based method provides a defensible, IFRS-compliant valuation.

Market Evidence Valuation

The market-based approach relies on comparables from recent acquisitions of similar vocational institutions or professional training centers. Although finding exact comparables can be challenging, evaluating transactions within the same geographic region or market segment provides valuable benchmarks. This approach helps validate assumptions used in income-based valuations and adds credibility to the purchase price allocation for regulatory, audit, and investor purposes.

Capital Cost Evaluation

The cost-based approach measures the value of assets based on their replacement or reproduction cost. Tangible assets such as classrooms, IT equipment, and training infrastructure are straightforward to evaluate using cost-based methods. Intangible assets, including proprietary content or digital platforms, can be valued based on development or licensing costs. While this approach may underestimate the economic value of revenue-generating intangible assets, it provides a baseline understanding of the tangible components of enterprise value.

Multi-Lens Valuation Approach

For vocational training centers, a hybrid approach that combines income-based, market-based, and cost-based methodologies often yields the most reliable and defensible PPA. Income-based valuations capture revenue potential, market-based assessments validate assumptions, and cost-based methods provide tangible asset insight. Integrating these methods ensures accuracy, transparency, and alignment with IFRS 3 requirements, particularly when intangible assets constitute the bulk of the enterprise value.

Complexities in Allocating Acquisition Price

Valuing Student Enrollment Contracts

Student contracts are the primary revenue drivers of vocational training centers but are inherently complex to value. Factors such as tuition rates, contract duration, likelihood of renewal, and student retention must be carefully considered. Overestimation can inflate goodwill and misrepresent the financial health of the acquired institution, whereas underestimation may undervalue the center and reduce investor confidence. Accurate valuation ensures that revenue expectations are realistic and that financial statements are reliable.

Quantifying Instructor Expertise and Proprietary Programs

Instructor expertise, professional certifications, and proprietary training programs significantly impact the center’s reputation, student outcomes, and competitive advantage. However, these assets are difficult to quantify due to their qualitative nature. Metrics such as instructor credentials, student success rates, program demand, and market recognition can be used as proxies. Proper documentation and valuation ensure these intangibles are fairly represented in the financial statements and can guide strategic investment decisions.

Documentation and Audit Preparedness

Thorough documentation of valuation assumptions, methodologies, and calculations is essential for audit readiness and regulatory compliance. Transparent and well-supported reporting reduces risks during audits, tax assessments, and investor inquiries. SMEs that maintain detailed records enhance credibility, defend their valuation methodology, and ensure that financial statements accurately reflect asset contributions.

Operational Impacts Implications of Accurate Allocation

Operational Decision-Making

Accurate allocation allows management to identify which programs, contracts, or assets contribute most to revenue and profitability. Insights derived from PPA can guide decisions on resource allocation, curriculum development, faculty investment, marketing strategies, and student retention initiatives. It also helps in optimizing operational efficiency and aligning post-acquisition activities with strategic objectives.

Mitigating Regulatory and Audit Risks

Properly allocated purchase prices ensure compliance with IFRS 3 and minimize the risk of discrepancies in financial reporting. By accurately measuring assets, goodwill, deferred taxes, and amortization schedules, vocational training centers can reduce audit, tax, and regulatory risks. Defensible PPA enhances transparency and credibility with auditors, regulators, and investors.

Enhancing Negotiation and Investor Confidence

A transparent and well-documented PPA strengthens the institution’s position in M&A negotiations. Clearly quantifying student contracts, proprietary programs, and instructor expertise can justify acquisition premiums and provide clarity during investor due diligence. This approach builds confidence among stakeholders and supports strategic post-acquisition integration and growth.

Conclusion

Allocation of acquisition price in vocational training centers is a multifaceted and strategic process that goes beyond basic accounting requirements. SMEs must identify, measure, and document both tangible assets, such as classrooms and IT infrastructure, and intangible assets, including student enrolment contracts, proprietary programs, certifications, and instructor expertise.

By adhering to IFRS 3 M&A reporting standards, vocational training centers ensure transparent, defensible, and reliable financial reporting. Accurate allocation supports operational decision-making, vocational training purchase price allocation, regulatory compliance, investor confidence, and strategic planning. Integrating multiple valuation methods, maintaining meticulous documentation, and recognizing the value of intangibles allows institutions to maximize acquisition benefits, align strategy with financial reality, and achieve sustainable growth in a highly competitive education sector.