Guide to IFRS 3 Purchase Price Allocation

Step-by-Step Guide to Allocating Purchase Price under IFRS 3

Understanding Guide to IFRS 3 Purchase Price Allocation

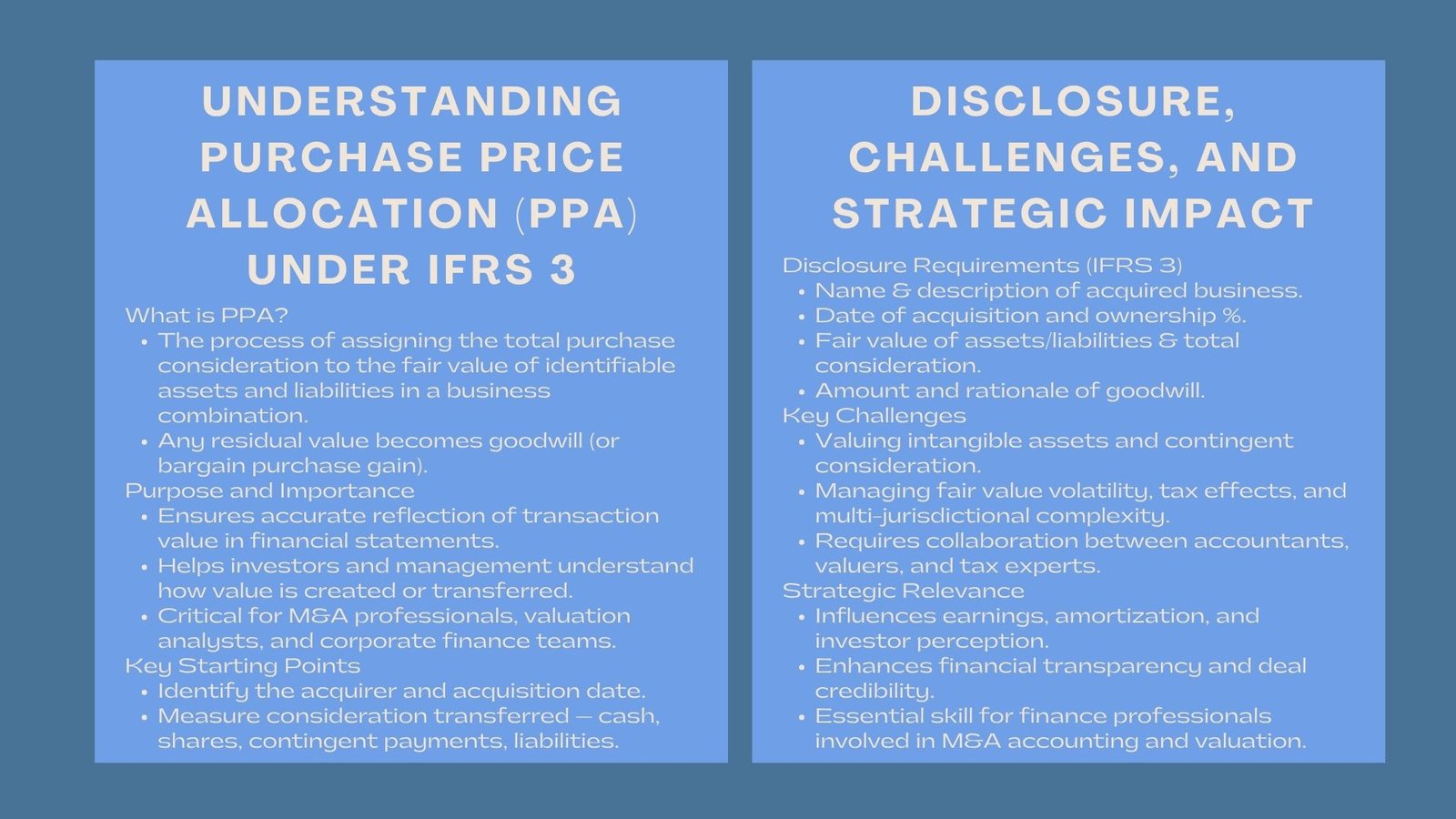

Business combinations are also some of the most complex in the financial reporting. In the acquisition of a company, it should decide how much was paid, what was acquired and how the aspects are reflected in the financial statements. This exercise is referred to as purchase price allocation (PPA) and it is regulated by International Financial Reporting Standard 3 (IFRS 3) – Business Combinations.

The nature of PPA consists in the assignment of the whole amount of consideration to be transferred to identifiable assets and liabilities of the acquired company at fair value where a residual amount would be identified as good will. Compliance is not the only element in this process, but rather it is about knowing how a transaction brings value or transfers value. To the finance employees, understanding this concept will enhance analytical and strategic decision making particularly in the merger and acquisition.

The Acquirer and Acquisition date.

The initial stage of IFRS 3 application is to decide on which party is the acquirer and which is the date of acquisition.

- Acquirer is the company that takes over the other party.

- The date of acquisition is the date when the control is acquired and is usually when ownership is transferred legally.

All assets, liabilities, and consideration measurements are made basing on their fair values as at this date. In the complicated transactions relating to joint ventures or share swaps, the determination of control may involve the estimation of voting rights, appointments to boards and decision-making authority. This is done properly and the basis of proper allocation of purchase price is established.

Measuring the Consideration Transferred.

After the acquirer and date have been determined, the second thing is to determine the value of the total purchase consideration. This includes:

- Cash or cash equivalents which were paid to the sellers.

- Acquirer issued equity instruments.

- Contingent consideration, e.g. earn-out or performance-based compensation.

- Any prior ownership interest which the acquirer already possessed.

- Liabilities undertaken in the deal.

Each of the components is measured at the acquisition date at fair value. This value might be difficult to determine in cases where shares, deferred payments or performance based clauses are set so models like discount cash flow or Monte Carlo simulations are usually used by valuation experts.

Recognising and Measuring Assets and Liabilities.

The IFRS 3 requires that all the identifiable assets and liabilities which satisfy the recognition criteria should be recorded separately at fair values. Common categories include:

- Physical resources: buildings, equipment, land, and inventory.

- Intangible assets: The customer relationships, technology, trade names and patents.

- Financial statement and liabilities: receivables, payables, and loans.

- Contingent liabilities: impending lawsuits or environmental liabilities.

All categories have to be evaluated differently. As an example, customer relationships can be ascertained at the multi-period excess earnings approach and the relief-from-royalty approach is used to ascertain trademarks. The identification of such items will eliminate the overstatement of goodwill and enhance the transparency to investors.

Purchasing of the Property.

The overall purchase price should be distributed between identifiable assets and liabilities with the remaining value having to be recognised as goodwill. The formula is:

Goodwill = Take into Account + Fair value of Non Controlling Interest + Fair Value of Previously held interest- Take into account + Net Identifiable Assets fair value.

When the outcome is negative then it implies that there is a bargain purchase that is, the buyer bought the target at a price lower than the fair value of its net assets. This gain is realised as profit or loss.

Goodwill is the anticipation of the buyer at the synergies, future growth, or unidentifiable intangible benefits. It is not amortised but has to be tested at the end of every year to determine whether it is impaired under IAS 36.

Identifying Contingent Consideration.

Congentent consideration, i.e. payments contingent on future performance, is a part of many modern M&A deals. Under the IFRS 3, they should be measured at fair value when they are acquired and they should be listed as part of total consideration.

Follow-up remenance is based on categorization:

- When categorization is a liability: alterations in fair value are recognised in the profit or loss.

- In case they are classified as equity: they are not remeasured following the initial recognition.

Proper estimation of these items is necessary to have accurate reporting and prevent volatility of post-acquisition earnings.

Deferred Taxes and temporary Differences.

Estimating assets and liabilities in fair value may produce short-term differences between their tax and accounting basis. The deferred tax assets or liabilities under IAS 12 arise out of these differences.

An example is the deferred tax liability which arises when an intangible asset is recognised to be accounted but not to be taxed. On the other hand, the deferred tax assets can be created by tax losses carried forward. Effective consideration of these will make sure goodwill and tax expense will not be misrepresented – this is the usual trap in acquisition accounting.

Member Adjustments and Measurement Period.

In most acquisitions, the post acquisition price is adjusted based on working capital, cash, or debt level differences. These reallocations are included in the final price purchase and should be reflected.

also permits a measurement period, which is usually not exceeding one year, in which the acquirer can revalue provisional fair values in case there should be new information relating to the conditions at the acquisition date. The changes occurring after this period are recognised in profit or loss and not as goodwill adjustments.

Documentation and Disclosure Requirements.

Under IFRS 3, there would be full disclosures of transparency and comparability. Financial statements should contain:

- Name and description of the business that has been acquired.

- The date of acquisition and percentage ownership acquired.

- The amount of consideration that was transferred and its key elements.

- The fair values of identifiable liabilities and assets.

- The goodwill quantity and the causes of its recognition.

Audit reviews are supported by detailed documentation and boost the stakeholder trust by providing explanations on why and why the acquisition happened.

Reasons Why Purchase Price Allocation is Important.

Precise allocation of purchase prices does not only have an impact on the financial reports, it also influences tax, investor view, and strategic decision-making. It has an impact on depreciation schedule, amortisation schedule, reported earnings and future impairment testing.

For professionals involved in M&A, valuation, or financial reporting, mastering this process offers a competitive advantage. Courses focusing on Step-by-Step Guide to Allocating Purchase Price under IFRS 3 and purchase price allocation training for finance professionals help participants develop practical expertise in applying IFRS standards, interpreting valuations, and aligning deal strategy with accounting outcomes.

Difficulties in Real-World Implementations.

As a matter of fact, it is not always so. Multijurisdictions, currencies, and business models are a common situation in acquisitions. The importance of the intangible assets such as software or the brand reputation is highly subjective and needs to be analyzed in the market. Also, the adoption of fair value estimates in consolidated reporting requires cross-functional working of accountants, valuers and tax experts.

Part of this process is starting to be made easier through technology and automation, however, professional expertise could not be replaced. Valuation defensibility and regulatory awareness require sound judgment and awareness of the regulations to assure that the valuation is in line with IFRS 3.

Conclusion

Purchase price allocation as per IFRS 3 is not just a mere accounting gimmick but rather a strategic activity, which integrates financial reporting and value creation by the company. Organisations can communicate the economic content of their transactions by determining what actually was bought and how much each element is valuable.

To finance professionals, knowledge of how to implement these principles increases the comprehension of mergers and acquisitions, builds credibility in the eyes of stakeholders and creates superior business decisions. When the world is dominated by constant consolidation and cross-border transactions, the skill of doing proper purchase price allocation is one of the most desirable technical skills in corporate finance, highlighting the value of Finance for Non-Finance Managers Singapore.