Advanced PPA Valuation Techniques for Financial Analysts

Purchase Price Allocation (PPA) Modeling Explained for Finance Professionals

Introduction to Advanced PPA Valuation Techniques for Financial Analysts

Mercers and acquisitions (M&A) can be considered to be the most strategic and complicated transactions of a company in terms of corporate finance world. In addition to purchase price and structure of the deal negotiations, there is one more process which is so important to influence the reflection of the acquired assets and liabilities in the financial statements of the buyer: Purchase Price Allocation (PPA). PPA modeling is important to the finance professional to be able to interpret financial reporting, compliance with the accounting standards and to be able to derive significant information about the value.

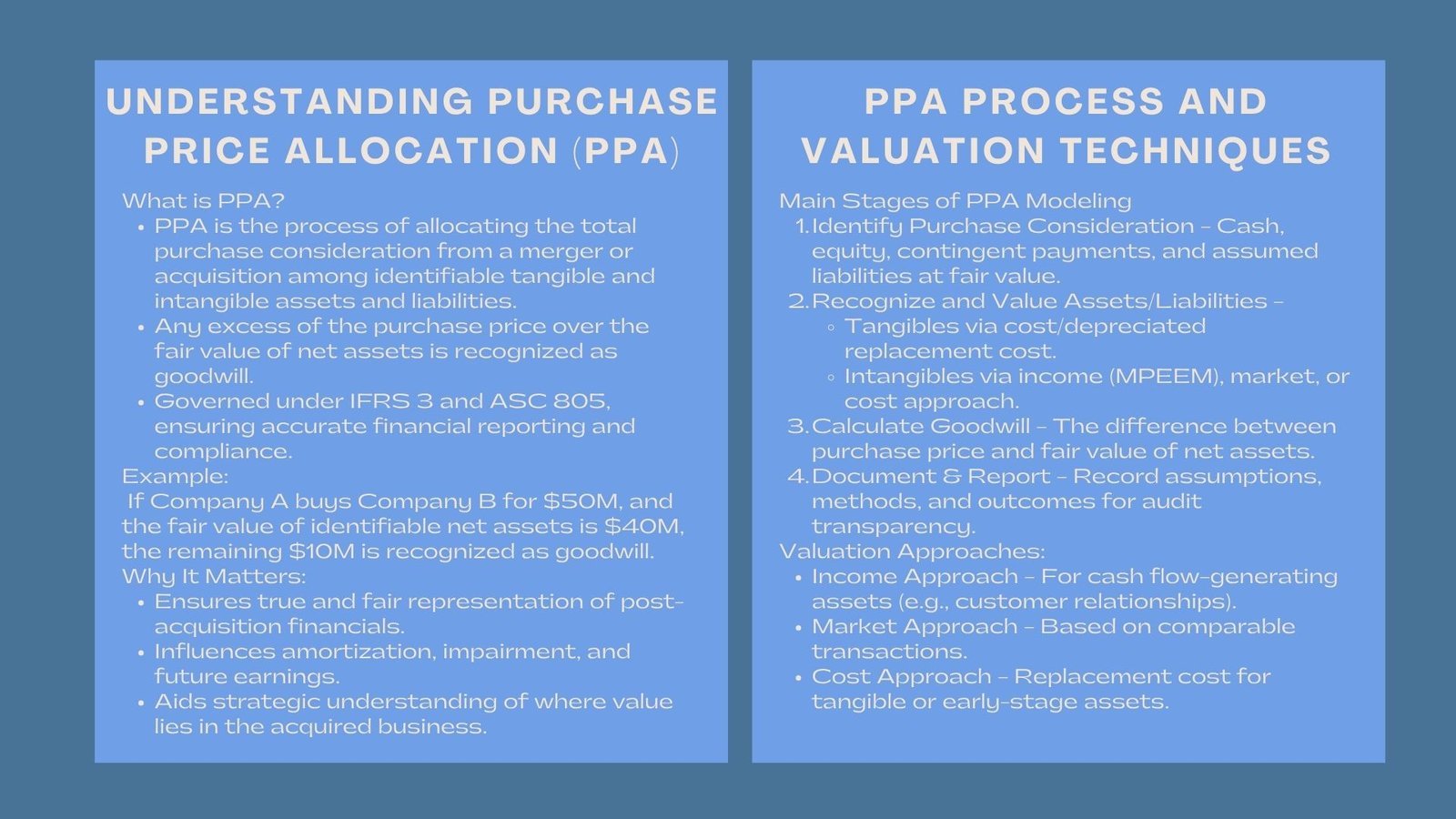

Learning the Concept of Purchase Price Allocation.

Purchase Price Allocation This is the method of splitting the overall purchase consideration paid to acquire a target company between identifiable tangible and intangible assets and liabilities of the acquired company. This is done by ascertaining that every element of the business being acquired is valued at the fair value as at the date of acquisition. Goodwill is paid out of any surplus of the purchase price in excess of the fair value of identifiable net assets.

As an example, in the case of Company A purchasing Company B at a price of 50 million dollars, identifiable (estimating) assets and liabilities (equipment, customer relations, patent, or brand name) are initially determined. Assuming that there are a total of 40 million of them, the other 10 million is a goodwill. This allocation has a direct effect on the financial performance of the acquirer after the deal, as it impacts on the cost of amortization and impairment testing in the future.

PPA modeling is not a mere accounting provision in the IFRS 3 and ASC 805, but it is also an analytic tool that assists the management to comprehend where the value is held in the business acquired.

The use and value of PPA Modeling.

Maintaining the Financial Statements Accuracy.

A correct PPA modeling gives a true and fair perception of the financial position of the acquired company. It removes the risk of overstating future periods earnings as it makes sure that such assets like customer contracts or technology are valued accordingly.

Improving Strategic Decision-Making.

A strong PPA analysis assists the management to analyze how they overpaid or underpaid to make an acquisition. The PPA outcomes can inform future strategic choices- either of where to invest or divest business lines- as they will emphasize the most valuable assets a company has.

Audit Compliance and Regulatory.

Both the IFRS and US GAAP require business combinations to be recorded under the acquisition method. The inability to conduct a proper PPA analysis may lead to regulatory, audit, or even restatement. Therefore, the finance departments have to collaborate with the valuation experts in order to develop documentation that becomes resistant to audit and regulatory scrutiny.

The main stages of PPA modeling process.

Identification of Purchase Consideration.

The former will entail establishing the total price of purchase of the target entity. These consist of not just the cash part but also equity issued, contingent consideration (e.g. earnouts) and any assumed liabilities. All the components should be determined at fair value during the acquisition date.

Recognizing and Measuring Tangible Assets and Liabilities.

Then, the finance professionals evaluate the fair value of identifiable physical assets including property, plant, and equipment. These valuations are usually done using depreciated replacement cost. Other liabilities like long-term debt, provisions and the deferred tax liabilities are also fairly valued.

Intangible Assets are recognized by the company only when they arise and their likelihood of generating economic benefit in the future is probable.

The greatest and most difficult aspect of a PPA is likely to be intangible assets. These may be customer relationships, technology, trademarks, trade names and non compete agreements. The multi-period excess earnings method (MPEEM) is used to assess the value of customer relationships or the relief-from-royalty method of trademarks are also applied.

Calculating Goodwill

After valuing all the identifiable assets and liabilities, the difference between purchase price and fair value of net identifiable assets is the goodwill. This figure includes the synergies, workforce value among other unidentifiable benefits anticipated to arise due to the acquisition. Though goodwill is not amortized, it has to be addressed and impaired annually.

Documentation and Reporting

After the overscheduling of the airline’s planes, this issue was noted to arise.This issue was reported to be experienced after the over scheduling of the airliners belonging to the airline.

Lastly, a detailed PPA report captures all assumptions, procedures and valuation decisions. This report helps in audit and regulatory review and gives transparency to the investors and management.

Widespread Valuation Techniques in PPA.

Different types of assets should be valued in different ways. Among the most common ones there are:

- Income Approach: Income approach is applied in case of assets that produce cash flows in the future i.e. customer relationships and invented technology.

- Market Approach: It is based on the market comparables, which can be transactions of similar companies or assets.

- Cost Approach: Determines the replacement or reproduction cost of an asset that is usually used on tangible assets or immature technology.

Every approach has to be implemented in a consistent manner with supportable assumptions and in line with the overall deal rationale

The Role of Finance Professionals in PPA

Finance professionals play a pivotal role in coordinating with valuation experts, auditors, and management to ensure that the purchase price allocation model in mergers and acquisitions aligns with the company’s accounting policies and business objectives. Their responsibilities often include:

- Re-examining the assumptions of valuation including discount rates, royalty and useful lives

- Determining how the amortization will affect the future earnings.

- Reporting findings to the top management and auditors.

- Making the Ppa results a part of the post acquisition financial systems of the company.

The measurement of fair value is complex; therefore, it requires a high level of technical skills and judgment.

Difficulties in PPA Modeling.

Valuation Complexity

The valuation of the intangible assets is subjective in nature. Reported goodwill and asset values can be greatly influenced by the selection of the valuation methodology, discount rate or assumptions of customer attrition.

Data Limitations

Acquirers also do not have access to detailed information about customer base or product margins of the target, thus it is hard to make valid valuation. The finance teams are thus required to utilize reasonable proxies and explain their assumptions.

Co-ordination and Timeliness.

PPA should be usually filled in the course of 12 months of the acquisition date. Scheduling of the work of valuation consultants, auditors and internal teams may be rather difficult under the conditions of strict time frames, particularly on large or cross-border transactions.

Best Practices of Effective PPA Modeling.

- Engage Early: Engage the valuation experts at the due diligence stage to preempt data requirements and valuation issues.

- Align with Strategy: Make sure the PPA assumptions are the reflection of the strategic intent of the management of the acquisition.

- Document Well: Keep comprehensive documentation of assumptions, calculations and methodology of validation of the process to assist the audit reviews.

- Reevaluation Post-Deal: Revise valuations where new information becomes known to the measurement period that would have an impact upon fair values.

- Take Technology: It is recommended to use the modern financial modeling software to automate calculations, enhance accuracy, and keep audit trails.

Adopting such practices can assist finance teams to provide credible and defensible outcomes that would contribute to strategic value rather than compliance.

How PPA Impacts Financial Reporting

The results of the PPA valuation process for financial reporting have far-reaching effects on an acquirer’s financial statements. Amortization of intangible assets directly reduces post-acquisition earnings, while goodwill impairment can lead to significant non-cash charges. The knowledge of these impacts will enable the finance professionals to estimate earnings in a more accurate way and present the results clearly to the stakeholders.

Also, value distribution between tangible and intangible assets will affect tax positions and other most important financial ratios including return on assets (ROA), or earnings before interest and taxes (EBIT). Thus, PPA is not only an accounting practice, it is the foundation of financial reporting analysis.

Conclusion

Purchase Price Allocation modeling is a skill that cannot be ignored by the finance professionals who are engaged in mergers and acquisitions. Correctly determining and assigning values to the acquired assets and liabilities, companies will be able to adhere to accounting standards, increase the level of transparency, and make strategic decisions. To practitioners, PPA modeling is not only about having the right financial reporting, but it is also about having the ability to see further into the creation and maintenance of value in an acquisition.