Practical Deferred Payment Valuation Course

How to Account for Contingent and Deferred Consideration in Acquisitions

Learn Practical Deferred Payment Valuation Course

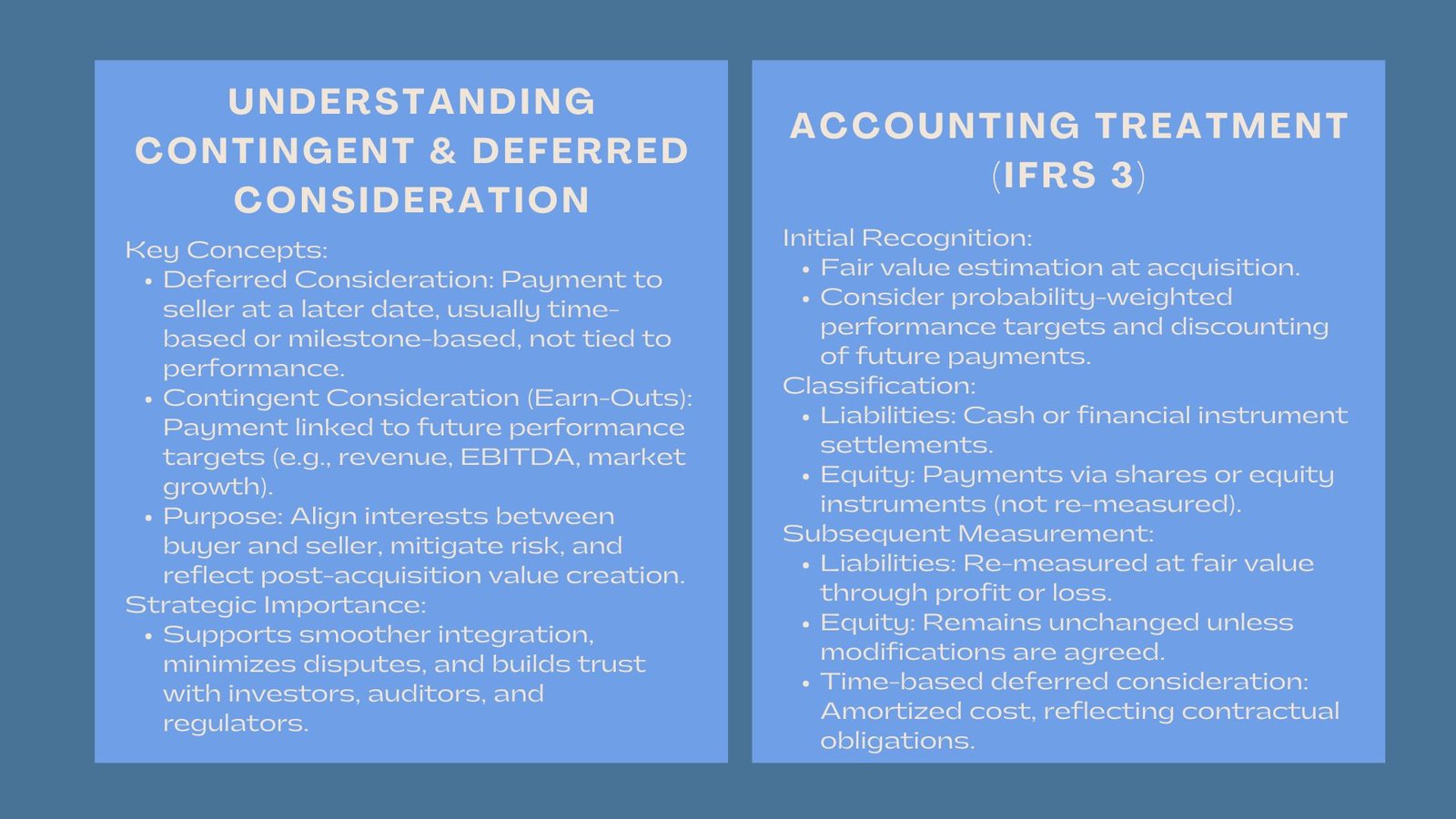

Purchasing price structures in mergers and acquisitions (M&A) are usually not limited to initial payments. Deferred and contingent consideration is a growing trend and can be used to bring about conformity of interest between the proprietor and purchaser as well as deal with risks. Contingent consideration generally involves such a performance measure as future success whereas the deferred consideration is the extension of a portion of the purchase price. The two forms have accounting and reporting problems using international accounting standards including IFRS 3 (Business Combinations).

It is of utmost importance that these factors are appropriately captured in order to produce the correct financial statements, to adhere to the regulations and to ensure that the stakeholders have their trust. It also impacts after-acquisition integration planning, taxation and perception on the part of the investors.

On top of these technical needs, an awareness of the contingent and deferred consideration will enable the companies to build more strategic deal structures, balance financial risk and establish accounting for contingent and deferred consideration in M&A under IFRS 3 alignment between management teams and new owners. In addition, close management of these factors will guarantee that post-closing business functions will be smoother, the possibility of disputes to a minimum, and the transparency to investors, auditors and other regulative bodies.

Understanding Contingent and Deferred Consideration

The deferred consideration is an obligation to pay the seller at a subsequent time usually with reference to time passed or achievement of a specific milestone contractually, but not based on performance. It can be installments or payments in the future of its acquisition.

In contrast, strategic management of earn-outs and post-acquisition payments contingent consideration is subject to the satisfaction of predetermined performance conditions, e.g. revenue goals, aircraft EBITDA or market growth objectives. This form of consideration involves division of risks between buyer and seller and motivation to further performance.

The first recognitions of the two types of considerations must be estimated with care on the fair value, liabilities or equity classification, and subsequent measurements under the liabilities or equity under the IFRS. By linking future payments to measurable performance, contingent consideration helps align interests between the buyer and seller and ensures that the acquisition price reflects actual post-acquisition value creation.

Accounting Treatment

Initial Recognition:

Contingent and deferred consideration are fair valued at the time of acquisition. Typically financial instruments, the probability-weighted performance targets are used, as well as, discounting of future payment.

Classification:

In case settled in cash or any other financial assets, it is registered as a liability.

When settled in terms of equity instruments, the same is considered as equity.

Liability classification: Payments settled in cash or financial instruments are classified as financial liabilities on the balance sheet.

Equity classification: Payments settled through issuance of shares or other equity instruments are recorded as equity, which generally will not be re-measured in subsequent periods.

Subsequent Measurement:

The IFRS 3 makes contingent consideration liabilities and profit or loss re-measurable at fair value under the same category, but equity-classified instruments are not affected by them. Performance-based Deferred consideration is a measurement that is usually an amortized cost, which is non-performance based and contractual. Typically measured at amortized cost, reflecting contractual obligations without adjustment for performance, unless modifications are agreed upon.

Conclusion

The consideration of contingent and deferred consideration is not a technical act, it indicates the strategic results of negotiations of an acquisition. When the IFRS 3 principles are applied properly, it leads to transparency, excellent reporting, and risk allocation. Buyers and sellers should work together in order to set some effective terms, sound measurement techniques and regular disclosures. Finally, accountability ensures that the stakeholders trust in these factors and the post-merger realisation of value.

In addition to the compliance, the knowledge of the subtleties of contingent and deferred consideration assists the organizations in making sound financial and operational judgments. It gives the management an idea of the timing of the cash flow, performance incentives, and the possibility of risk and thus companies find it easier to integrate the acquisitions without compromising the strategic goal and shareholder trust in a company. By distinguishing between time-based obligations and performance-based conditions, companies can strategically manage post-acquisition cash flows, protect shareholder value, and maintain transparency in financial reporting.