Certified Fair Value Equity Valuation Course

Fair Value of Equity Consideration in Business Combinations

Introduction: Certified Fair Value Equity Valuation Course

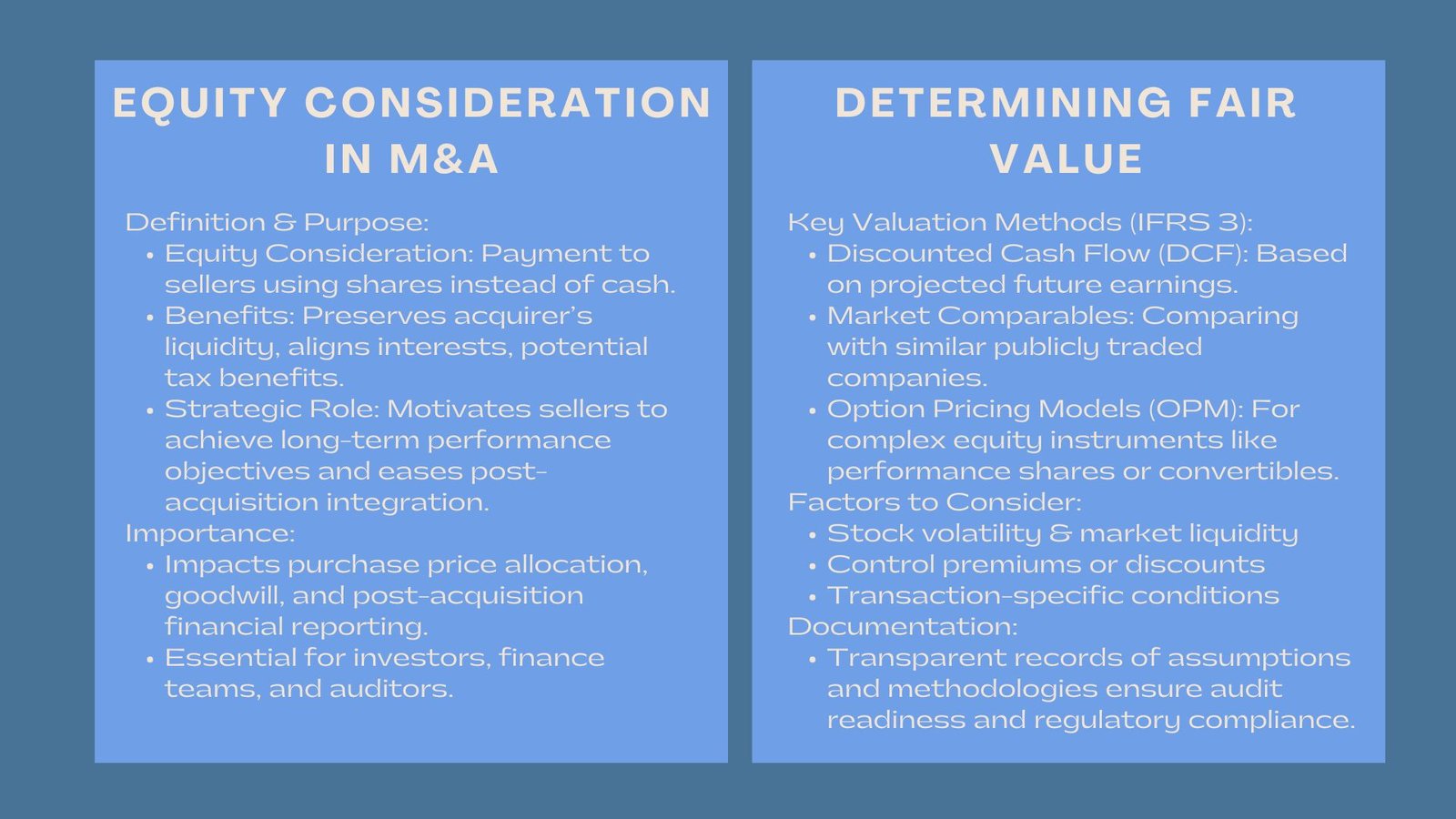

Equity consideration is emerging as a popular trend in mergers and acquisitions as a form of cash-free compensation of the sellers. Such an approach places liquidity at the disposal of the acquirer, balances the interests, and even can lead to tax benefits. However, it must also give due diligence to the fair value of the issued equity according to the IFRS 3 that has a direct impact on purchase price allocation, goodwill and the financial statements after the acquisition.

The equity valuation is a concept critical to the financial analysts, corporate finance department and the investors that estimate the value of the equity and authenticity of the equity report of such a transaction. Besides accounting, other aspects of post-acquisition governance include equity consideration as well as incentives to shareholder relations and management.

When such equity payment should be sufficiently valued and designed, the companies may ensure that the sellers will remain motivated to achieve the performance objectives in the long-term, and the buyers will enjoy the financial freedom and will be able to reduce the cash outflow to zero that will simplify the process of the integration in the future, and its profitability in the long-term.

Determining Fair Value

Fair value consideration of the value of equity, in the majority of cases, is based on the value of shares that are quoted on the acquisition date. The methods of valuation that can be used to determine the share fair value of equity consideration under IFRS 3 in business combinations in case of the non-public companies include the discounted cash flow (DCF), market comparables and the option pricing models.

Publicly traded, determining fair value requires professional judgment and the use of established valuation techniques such as the Discounted Cash Flow (DCF) method, market comparables, or option pricing models (OPMs) for complex equity instruments like performance shares or convertible options. Each of these approaches requires rigorous assessment of underlying assumptions, future earnings projections, discount rates, and market volatility.

Some of the factors to be considered during the determination of fair value include:

- Stock volatility

- Market liquidity

- Premium or discounts on acquisition control.

- Transaction-specific conditions

Accurate fair value determination ensures that both buyers and sellers receive a fair reflection of the transaction’s economics and protects the acquirer from future restatements or audit challenges. Transparent documentation of valuation assumptions is critical for audit readiness and regulatory compliance.

Accounting Treatment

The purchase price allocation (PPA) and the goodwill recognition are subject to the equity consideration:

- Share instruments that are sold to the seller are at fair value.

- Issue value of share is a component of the total consideration of calculating goodwill.

- All expenses incurred in regard to issuing stocks are usually charged to reduce equity, and not expense.

Audit readiness and understanding of the assumptions and methodologies employed requires clear documentation of the same. Importantly, transaction costs directly attributable to the issuance of shares (such as underwriting fees, professional advisory costs, or share registration expenses) are not expensed in the income statement. Instead, they are recorded as a deduction from equity, consistent with accounting treatment of share-based purchase consideration in M&A transactions the treatment of capital-raising costs under IFRS. This ensures that the profit or loss for the period remains unaffected by costs that are directly related to equity issuance rather than operating activities.

Comprehensive documentation of the assumptions, valuation methodologies, and supporting analyses used in determining the fair value of equity is essential. This includes internal memos, valuation reports, and management representations. Such evidence supports both audit verification and regulatory review, and helps ensure that the PPA outcomes can withstand scrutiny from investors, analysts, and financial authorities.

Conclusion

Equity consideration is a strategic and a financial business tool in business combinations. Valuing of shares fairly will guarantee adherence, just treatment of sellers and the dependability of post-acquisition reporting. Valuation and disclosure of all material facts with proper valuation boosts trust among the stakeholders, well-organized integration planning, and protects the integrity of the reported goodwill.

Also, the equity consideration has the potential of having an impact on the post transaction culture and governance of the combined entity. Issuance of shares will make the sellers interests consistent with the interests of long-term business performance and commitment towards corporate strategy and also will minimise cash outflows. Strategic value of the acquisition may also be good thus the accurate accounting and valuation are not only required by regulations but may also add more credibility to the acquisition. As such, accurate accounting and fair valuation are not merely regulatory requirements—they are enablers of credibility, partnership, and sustained business value creation.