Certified Post-Acquisition Adjustments Training

Post-Acquisition Adjustments: Revisiting Purchase Price and Fair Value Changes

Introduction to Certified Post-Acquisition Adjustments Training

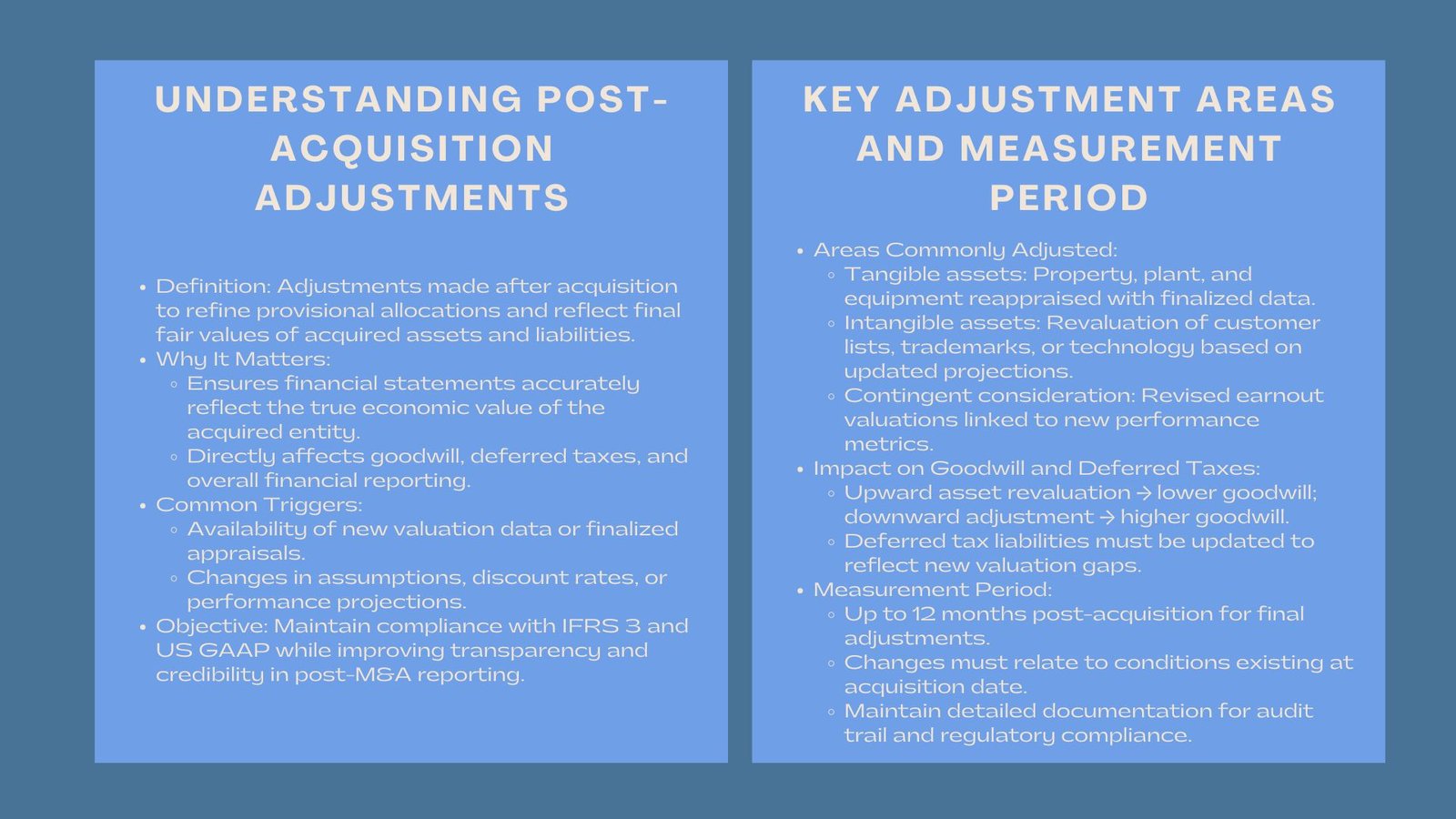

Acquisitions are not easy deals and even when the final price is set the finance department usually has to re-assess the original allocations to incorporate new facts or amend the tentative calculations. Adjustments made after the acquisition is a very important action that should be taken to allow financial statements of a company to reflect the true value of assets and liabilities that are acquired.

Such adjustments may be quite influential on the goodwill, deferred taxes, and the financial reporting generally of the acquiring organization. Knowledge on how to regulate and record these adjustments is critical in accountants who would like to remain in line with IFRS 3 and US GAAP and at the same time give reliable and transparent information of the reported financial transactions.

The motive of Post-Acquisition Adjustments.

Adjustments at the time of acquisition relate mostly to differences between a set of provisional allocations of assets, liabilities, and contingent considerations as at the date of acquisition and the ultimate fair values of those assets, liabilities and contingent considerations. In the first purchase price allocation, there could be provisional valuation of some of the assets since some information could be unavailable or appraisal could be pending. More precise data will be available, and firms must reconsider such allocations in order to capture economic reality. The process would make sure that the balance sheet of the company has been prepared in the correct manner of reflecting the value of the acquired entity and that goodwill is properly computed.

General Areas that need to be adjusted.

There are also a number of areas that need post acquisition review. Physical assets like property, plant and equipment can require adjustment in the event of final appraisal values which do not reflect the same values. The customer list, patents and trademarks are the other intangible assets that are sensitive to updated projections and market based valuation. Recalibration of contingent consideration or earnouts could also be required using a revised set of performance metrics or the attainment of certain milestones.

During this phase, finance teams may conduct a post-acquisition purchase price adjustments review to verify that all allocations are accurate. This review involves comparing provisional amounts to the final fair values and documenting any changes in assumptions or methodologies.

Revisiting Fair Value Calculations

Fair value is a central concept in post-acquisition adjustments. The fair value of an asset or liability represents the price that would be received in a transaction between willing parties at the measurement date. After the acquisition, it is often necessary to perform a fair value reassessment of acquired assets, especially when initial valuations were based on incomplete data. This may involve revising cash flows projections, the discount rates, or revising the market comparables of the intangible assets. Proper re-evaluation will make the financial statements accurate to show the actual economic value of obtained resources.

Adjusting of Goodwill and Deferred Taxes.

The fair value of assets and liabilities also changes directly to influence the calculation of goodwill. In case there is an upward revaluation of assets, then the goodwill will reduce; and vice versa, in a case there is a downward adjustment of assets value, the goodwill will rise. Equally, change in deferred tax liabilities might have to be done to show the differences in accounting and tax bases. When these adjustments are managed in a proper way, it will help to fulfill the accounting standards and prevent possible restatements.

Time and Period of measurement.

Both IFRS 3 and US GAAP have a measurement period of up to 12 months of the date of acquiring the asset to complete purchase price allocations. At this time, provisional amounts may be changed to correspond to new information regarding facts and circumstances that were present at the acquisition date. Businesses are required to have a good record of justification of changes and the ways through which the revised values are being measured. This documentation is essential in terms of internal review, external audit and regulatory compliance.

Real-life Guidelines of Finance Teams.

The process of post-acquisition adjustments involves cooperation between the finance and valuation experts and auditors. Finance departments have to make sure that all the supporting evidence of asset valuation and liability assumptions are gathered and examined. The valuation specialists aid in the independent verification of the value of intangible assets and assists in aligning cash flow projections with market expectations. Auditors scrutinize such adjustments to ascertain that they are reasonable, and/or consistent with accounting standards and the financial statements reflect them solidly.

It is necessary to thoroughly communicate and document assumptions, methodologies and changes. Lack of transparency may cause confusion by the stakeholders and enhance audit risk.

Risks and Common Pitfalls

In spite of the planning, a number of risks may undermine post-acquisition adjustments. The major traps are the use of outdated or un-reconducted information, mis-classification of assets or liabilities, over-stating future cash flows and understating contingent liabilities. A common mistake is the inability to properly document the reasons behind changes that can pose difficulties in the course of the audit or regulatory inspection. These risks can be enabled by taking proactive measures that will allow finance teams to have correct and justifiable reporting on post acquisition.

Best Practices of Effective Adjustments.

In order to be more accurate and compliant, several best practices should be adopted by the companies. Start by carrying out a good reconciliation of the tentative purchase price and ultimate valuations. Make sure any assumptions taken in the fair value are backed by factual and evidence based data. Periodically liaise with valuation experts to justify methods, especially where complex intangibles are being assessed or contingent liabilities have arisen. The audit trail of all the adjustments that are made with supporting documentation and approvals is critical in both internal and external control. The steps would assist in creating a defensible process of adjusting the post-acquisition process of purchase prices and enable a fair valuation of the acquired property.

Conclusion

The use of post-acquisition rebalancing is an essential component of the accounting of M&A, which should help to present the financial statements in the way that the value of acquired liabilities and assets is correctly reflected. Through meticulous examination of tentative allocation, fair value re-evaluation of acquired assets and systematic post-acquisition purchase price adjustments, the compliance can be maintained, transparency increased, and the stakeholders can be furnished with dependable financial data by the professionals of finance. A good balance sheet integrity and goodwill calculations deferral and general adjustments management protects are conducive to a good post-acquisition financial reporting.