Professional Intangible Asset Valuation Workshop

Valuation of Identifiable Intangible Assets in PPA (Customer Lists, Brands, IPs)

Introduction: Professional Intangible Asset Valuation Workshop

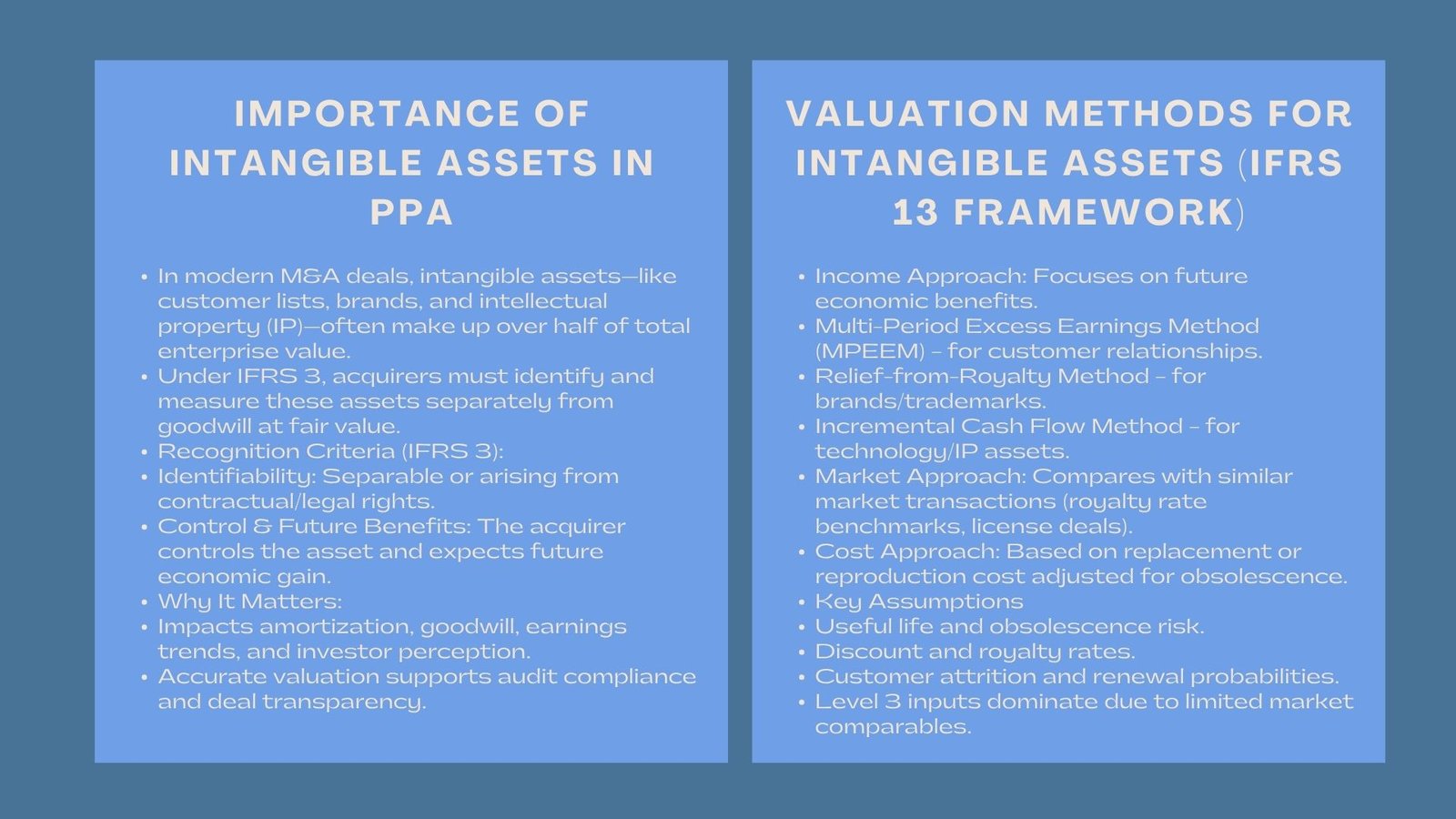

Not every business combination will have tangible or visible assets that are purchased. The true value of a company is often found in its intangible resources that include the customers who are loyal to it, brand loyalty that has been built through the years and the intellectual property (IP) that drives innovation. These factors are decisive in the pricing of an acquisition and allocation of purchase price later in financial reporting.

Under IFRS 3, the acquirers should be able to identify and measure the identifiable intangible assets at fair value during Purchase Price Allocation (PPA). To the finance experts, it is necessary to know how to properly value these assets under the IFRS 13 so that they can report on them in a transparent, defensible, and compliant manner.

Intangible Assets and their significance in PPA.

During recent dealings, intangible assets may consume over a half of the total enterprise value. These assets are valuation based with the determination of the future amortization and earnings trends in addition to allocating the goodwill and identifiable intangibles.

Making the right choice influences investor perceptions of a successful deal and auditor opinion concerning compliance. Misvaluation on the other hand may result in misorganized profitability values and heightened audit examination.

That is why practitioners conducting PPA need to form an extensive insight into the character and economic value of intangibles like list of customers, trademarks and technology assets.

What Should Be Treated as an Identifiable Intangible Asset.

There are two essential criteria of recognizing the intangible assets as defined by IFRS 3 in the separation of the assets with goodwill:

- Identifiability – The asset either has to be separable (can be sold or licensed separately), or it is due to contractual or legal rights.

- Control and Future Economic Benefits – The acquirer should be in control of the asset and anticipate it to give estimated economic benefits in future.

Once such conditions are satisfied then the intangible assets are identified separately in the PPA, and not absorbed in the goodwill.

Common Types of Identifiable Intangible Assets

Customer Lists and Relationships

Customer-related intangibles represent one of the most valuable categories, as they reflect the strength of existing relationships and recurring revenue streams. The valuation of customer relationships in purchase price allocation often uses income-based methods to estimate the future cash flows derived from continuing customer interactions.

Value is commonly measured by analysts evaluating contract terms, attrition rates, contribution margins, as well as renewal probabilities. The resulting fair value gives a fair estimate of the financial value of long term customer loyalty.

Brands and Trademarks

Brands capture market awareness, consumer belief and competition distinction. They are frequently valued using the relief-from-royalty approach which approximates the amount of royalties a firm would have paid should it have been obliged to license its brand. Assumptions made are projected revenue on branded products, royalty rates benchmarks and reasonable discount rates.

Strong brand equity is usually affirmed into superior valuation multiples, yet auditors examine the rationale behind any chosen royalty rates and growth projections.

Technology and Patents: Intellectual Property.

Intangible assets that involve technology are patents, software, proprietary algorithm, and formula of a product. IP valuation is determined based on its legal protection, anticipated economic life and in terms of future revenue generation. The most common are cost-based approaches (early-stage technology) and income-based approaches (commercialized IP).

With fast technology shifts and competitive innovation, it is very essential to evaluate the risk of obsolescence and the problem that the newer developments may cannibalize the older ones.

Valuation Framework under IFRS 13

IFRS 13 provides a unified framework for measuring fair value, emphasizing market-based rather than entity-specific assumptions. The intangible asset valuation techniques under IFRS 13 fall broadly into three categories: income, market, and cost approaches.

The application of each of the methods needs inputs of the fair value hierarchy, including observable market data (Level 1) and unobservable model-based inputs (Level 3). The Level 3 inputs prevail on a majority of intangibles because they cannot be compared in the market.

Income Approach: Financing Future Economic Advantages.

It is the most popular approach to intangible assets as they indicate their ability to generate income. It is done by predicting the cash flows that have been attributed to the asset and discount them to the present value at a reasonable rate.

Typical examples under this method are:

- Multi-Period Excess Earnings Method (MPEEM): It is normally applied in customer relationships. It separates the cash flow that can be attributed to the asset upon subtracting the returns on contributory assets, including working capital or fixed assets.

- Relief-from-Royalty Method: This method is mainly applied to the brands and trademarks. It appreciates the asset by making projections of the hypothetical royalty it foregoes by owning.

- Incremental Cash Flow Method: It is applicable to technology assets and centers on incremental earnings of the IP in comparison with a base case without the IP.

The income technique has a direct relationship between the projected financial contribution of the asset and its valuation yet it demands strong assumptions regarding the growth of revenue, attrition and discount rates.

Market Approach: Benchmarking on Market Data.

Where there are observable market transactions of similar assets, it can adopt the market approach. It is a method that compares the asset value with similar sales or licensing transactions.

Nevertheless, similar information regarding such specific assets as proprietary software or niche brands is frequently limited. Where these are involved, analysts can employ the general industry ranges of royalty rates, based on the quality of assets and location in the market.

Cost Approach: Reproduction/ Replacement Perspective.

In the case of assets that lack direct sources of income and market analogs, the cost approach can be used as an alternative. It approximate the cost that is needed in order to restore or replace the asset and this is adjusted to physical, functional or economic obsolescence.

This technique is better applied on early stage technologies, internal databases, or even ongoing R&D projects, where future revenue cannot be well determined, but development expenditure can be calculated reasonably.

Key Inputs and Assumptions

Proper valuation of the intangible assets is largely dependent on the choice of realistic assumptions. Key inputs include:

- Useful Life: The useful life is the determination of the duration during which the asset is expected to bring economic benefits taking into consideration technological or market fluctuations.

- Discount Rate: It represents the risk profile of the cash flows of the asset.

- Royalty Rate: Comparing with the industry data bearing in mind brand strength and exclusivity.

- Customer Attrition Rate: The anticipated reduction in the number of customers with passage of time.

Market evidence or historical data should support each and every assumption well to pass the audit.

Ordinary Problems in Intangible Valuation.

Limited Market Evidence

There are few active markets in which intangibles are traded as opposed to tangible assets and it is therefore hard to determine observable prices. It leads to increased dependence on Level 3 inputs and discretion.

Asset Interdependency.

The relationships with customers, the brands and technologies tend to collaborate in creating the value and it is difficult to distinguish between the separate contribution of each one. Analysts should be keen to assign revenues to prevent counting them twice.

Audit Challenges and Subjectivity.

Since there is a level of estimating involved, auditors need precise documentation of methods, assumptions and sensitivity analysis. Any slight modification in discount or royalty rates may result in huge valuation adjustments.

Finance Professionals Best Practice.

Begin with an In-depth Business Intelligence: Understand the value sources of the acquired company, its customer behavior and market information and then choose valuation techniques.

- Apply a variety of methods when it is possible: Cross-validation is more reliable and it offers defendable findings.

- Document Key Judgments: Have detailed working papers that describe assumptions and sources of data.

- Work with Specialists: As a methodological safeguard, valuation professionals should be involved to adhere to IFRS 13.

- Re-assess Intangible assets values: Re-review intangible assets values when new information is discovered during the measurement period or during later impairment testing.

Strategic intelligence of Intangible Valuation.

In addition to compliance, cognitive knowledge of intangible value is used as the management is able to identify what is actually contributing to competitive advantage. Power of customers could be reflected in the pricing power, whereas innovation ability is exhibited in the valuable IP.

Valuation process therefore becomes a strategic activity which bonds the fair value accounting with the actual economic performance. It also assists acquirers to estimate priorities of integration and post-acquisition measures of performance referring to value creation in intangibles.

Conclusion

Characteristic intangible resources like customer listings, brands, and intellectual property are key elements in current business combinations. Correct value determination according to the IFRS 13 guarantees openness, uniformity and strategy. To the finance person, the perfect mastering of these principles of valuation is not only mandatory in the adherence to the accounting requirements but also exposes the real motives behind the sustainability of value in any acquisition.