Purchase Price vs Enterprise vs Equity Value

Difference Between Purchase Price, Enterprise Value, and Equity Value

Learn Difference Purchase Price vs Enterprise vs Equity Value

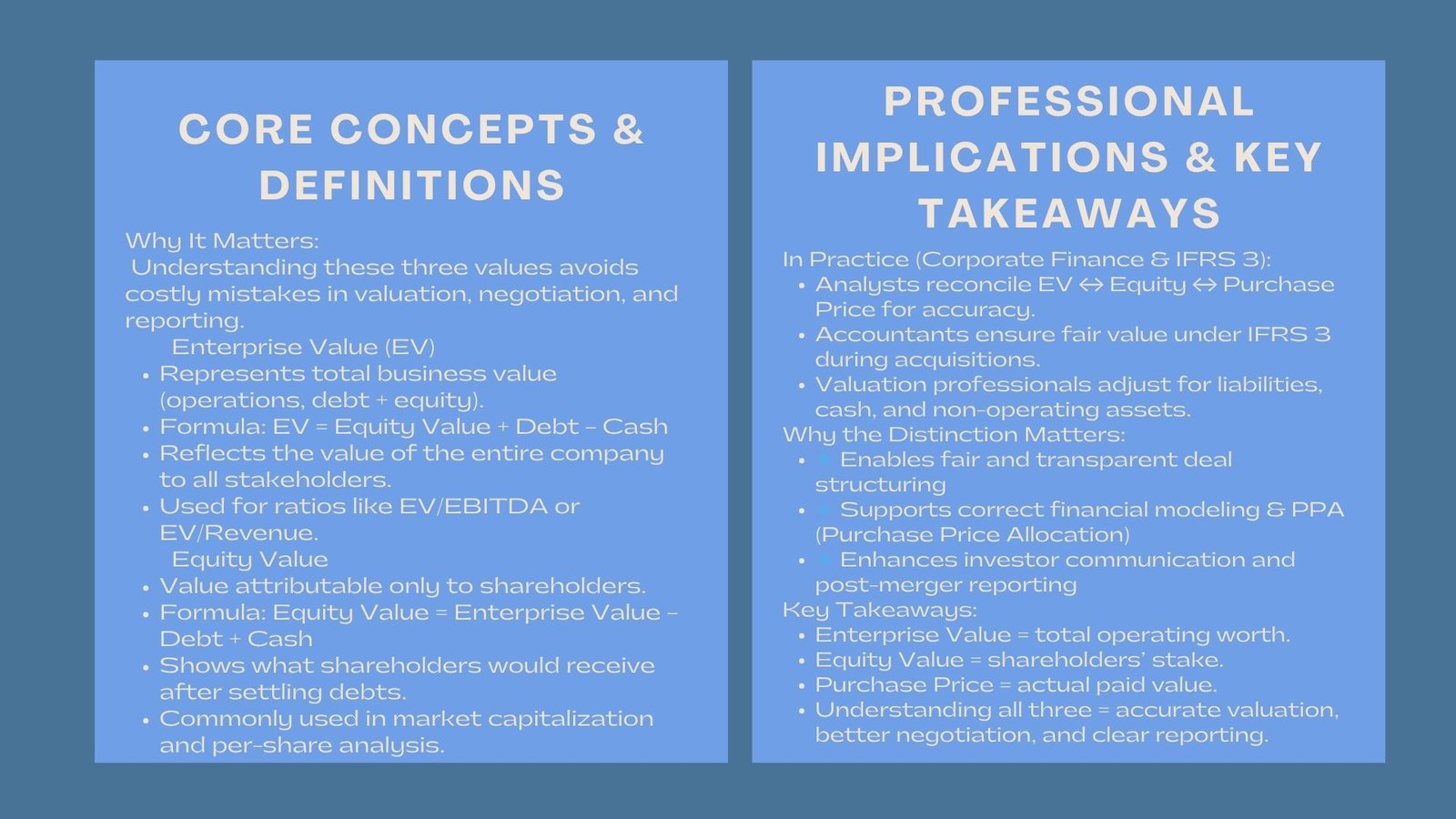

When engaging in mergers, acquisitions, and corporate valuations, the distinction between purchase price, enterprise value, as well as equity value is a basic need to know. All terms represent a different understanding of what a company is valuable – and their misconception may result in expensive mistakes during negotiation, financial modeling, and accounting.

Although the concepts are interdependent, they have various applications; enterprise value is the total worth of a business, equity value is the value of shareholders and purchase price is the actual price that was paid during a transaction. Understanding such differences, one can be more effective in analyzing deals and presenting the results of valuation clearly and confidently.

Enterprise Value Understanding.

Enterprise Value (EV), is also commonly known as the total value of a company since it is the value of both the debt and the equity i.e. the amount that an acquirer would have to pay to acquire the whole business.

It can be considered as the worth of operations of the company, its capital structure not depending. In formula form:

Enterprise Value = Equity Value + Debt -Cash and Cash Equivalents.

This method gets rid of the impacts of financing decisions and offers a clean comparison among companies. EV is typically applied in rates of valuation like EV/ EBITDA or EV/ Revenue, wherein the analyst can decide to compare performance without regard to the method of business funding.

As an example, considering two companies that have equal income but different debt rates, enterprise value provides a better insight on the actual economic value of companies. It incorporates all claims, both to shareholders and other lenders, of the aggregate market value of assets and operations of the company.

Understanding Equity Value for Company

On the other hand, Equity Value is the value of that which is attributed to shareholders of the company; the owners of the company. It is computed by dividing the market capitalization (in case with public companies) or guessted equity value (in case with confidential companies) with the items such as preferred shares or stock options frequently eliminated.

The formula may be outlined as follows:

The value of equity is calculated as the difference between the enterprise value and the debt plus cash.

This is what will be given to the shareholders in case the company was sold, when the outstanding debt and liability were settled.

Equity value plays a vital role in the investors as it represents the potential of returns should one own the stock of the company. It is also used to compute the value of per-share and comparing investment opportunities in the equity markets.

In valuing a company involved in a merger or acquisition, equity value will make sure that the acquirer and the target agree on the amount of the entire business value attributable to shareholders and to debt holders.

Understanding Purchase Price

Purchase Price is defined as the sum of money spent by the buyer to acquire a product or service. Purchase Price Purchase Price refers to the amount paid by the buyer to obtain a product or service.

Purchase price is a consideration actually passed by the buyer to gain control over the target company. It is the number negotiated at some deal and it may be cash, stock, taking on a debt or contingent payments.

Although the purchase price may be based on the enterprise value, it is usually adjusted on various grounds prior to the transaction being finalized such as net debt, working capital targets and any other post acquisition adjustments.

Basically, the purchase price harmonizes the theoretical valuation (EV and equity value) and the actual transaction terms. It indicates not only financial models but also a strategic incentive, bargaining power, and market dynamics.

Linking Enterprise Value, Equity Value, and Purchase Price

The connection between these three values can be concluded in the following way:

- Enterprise value gives the total value of the business in terms of debt and equity.

- Equity value expresses the amount of value which is held by shareholders after net debt has been deducted.

- The final amount that is paid by the acquirer to acquire ownership is purchase price.

Generally, the purchase price begins at enterprise value, and modifies to include debt, cash and others to determine the ultimate sum that will be paid to the shareholders.

To illustrate, a company of USD 100 million in terms of enterprise value, USD 30 million in debt, and USD 10 million in cash could be used. The equity value would USD 80 million. When the acquirer is willing to ensure it pays 10% premium, the ultimate price of purchase would be USD 88 million – both market dynamics and negotiation results.

Typical Adjustments of the Purchase Price.

In real life deals, the ultimate sale price is hardly the same as the original enterprise price. A number of changes may influence it:

- Adjustments of net debt: Buyers deduct debt and add cash to make the net purchases that they are actually making of the equity portion.

- Working capital adjustments: A normal working capital target is frequently part of a deal in order to maintain a stable working capital at closing.

- Future-based consideration: Earn-outs may be contingent on future performance either raising or lowering the final payment.

- Transaction cost and liabilities: The purchase consideration can be lessened by legal, advisory or restructuring cost.

Such modifications are essential to equitable and transparent execution of dealings particularly with an acquisition across borders or in a complex acquisition.

Valuation in Practice: How Professionals Apply the Concepts

In corporate finance, understanding how these values interact is vital for accurate valuation modeling, due diligence, and financial reporting.

For instance, analysts performing enterprise value to equity value reconciliation must adjust for all financial liabilities, non-operating assets, and equity instruments to ensure a clean bridge between theoretical and transactional values.

Similarly, finance managers engaged in purchase price allocation under IFRS 3 in Singapore must ensure that the recorded consideration accurately reflects fair value at the acquisition date — a process that requires deep technical expertise in valuation and accounting.

Why the Distinction Matters for Finance Professionals

For finance professionals, the ability to distinguish among these valuation measures is more than an academic exercise. It’s a strategic skill that impacts negotiations, investor communication, and post-acquisition accounting.

Knowing how enterprise value, equity value, and purchase price interconnect helps professionals:

- Assess whether a deal creates or destroys shareholder value.

- Interpret valuation multiples correctly.

- Structure fair offers and counteroffers.

- Anticipate how adjustments impact financial statements post-merger.

Professionals trained in corporate valuation and financial modeling can navigate these complexities confidently, ensuring that their analyses withstand audit scrutiny and align with global standards like IFRS and GAAP.

Key Takeaways

- Enterprise Value = total operational value (equity + debt-cash).

- Equity Value = the value of the shareholders in the business not including debt.

- Purchase Price = the ultimate negotiated price to purchase control.

- Debt, cash and working capital adjustments are used to fill the EV-purchase price gap.

- The knowledge of such differences will guarantee proper valuation, superior negotiation and clear financial reporting.

Conclusion

The variation of purchase price, enterprise value and equity value determines the manner of analysis, structuring and entry of transactions. Whereas enterprise value gives all the value of the operations of an enterprise, equity value separates the stake of the shareholders and purchase price gives the actual value that is exchanged during an acquisition.

With such differences, the professionals in the field of finance will be able to approach valuations and M&A deals with greater accuracy and insight. Whether it is a deal, valuation engagement, or a financial modeling project, these underlying principles are all that make the difference in a good corporate finance practice.